Your thoughts on SCOTUS decision on student loan denial

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

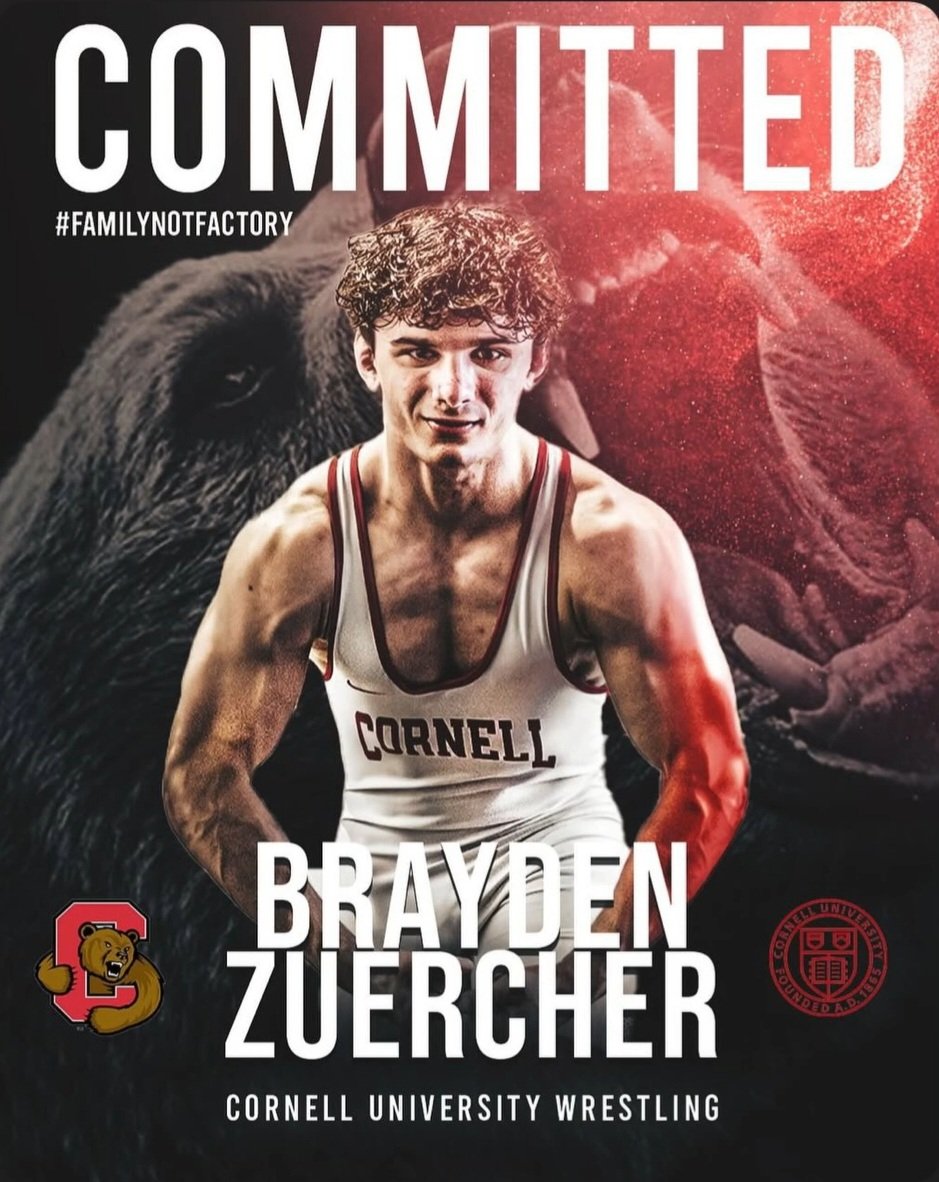

College Commitments

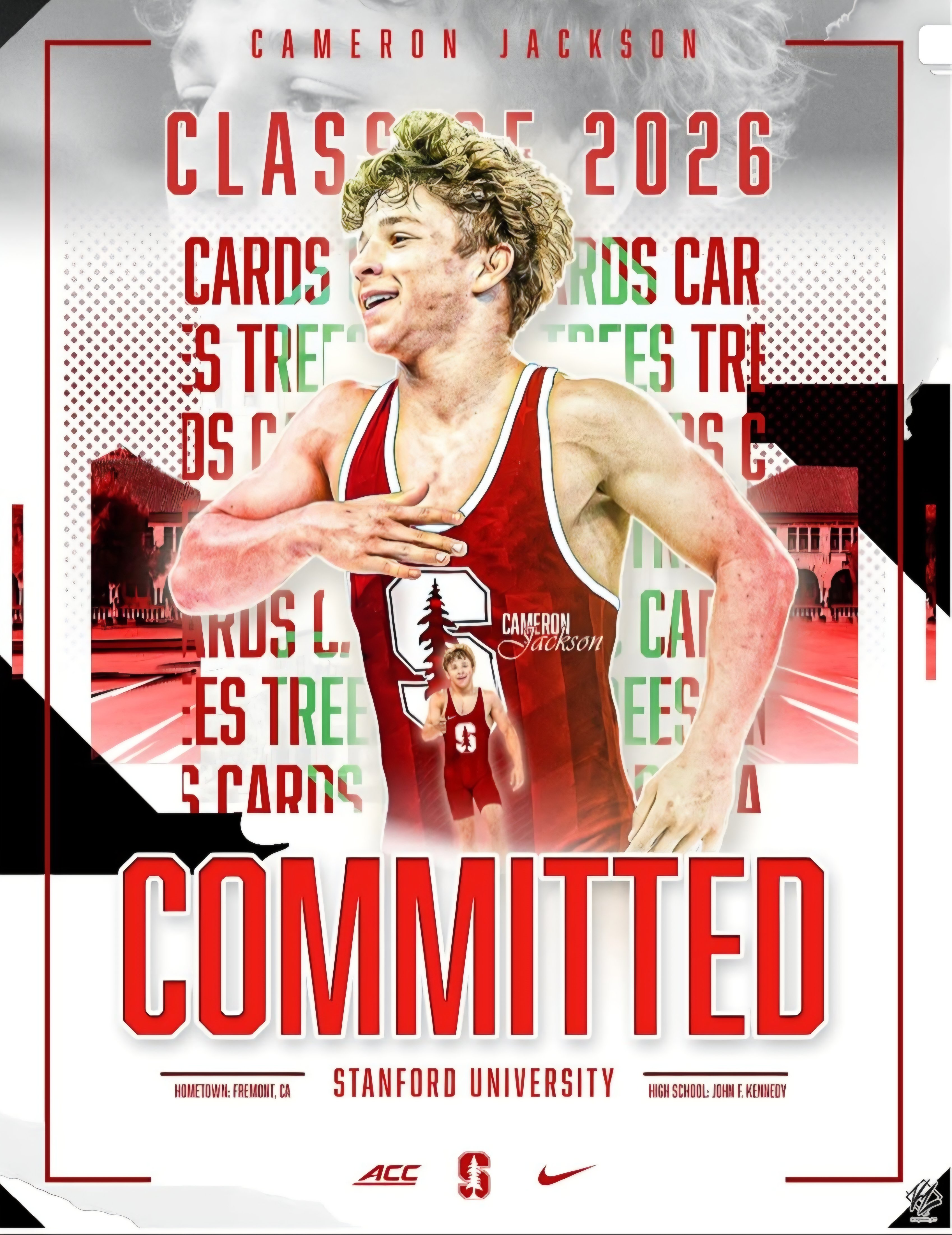

Cameron Jackson

Kennedy, California

Class of 2026

Committed to Stanford

Projected Weight: 125

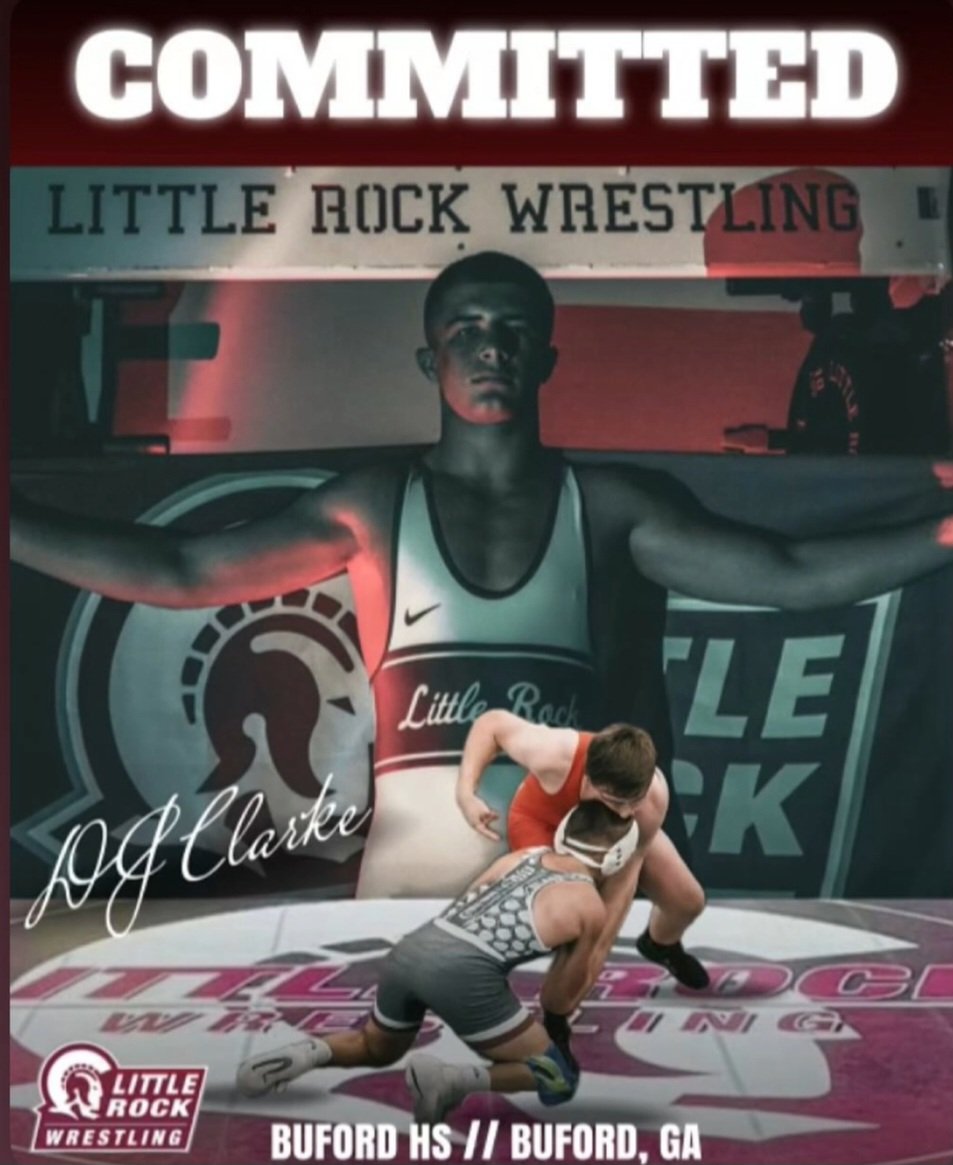

DJ Clarke

Buford, Georgia

Class of 2026

Committed to Little Rock

Projected Weight: 133

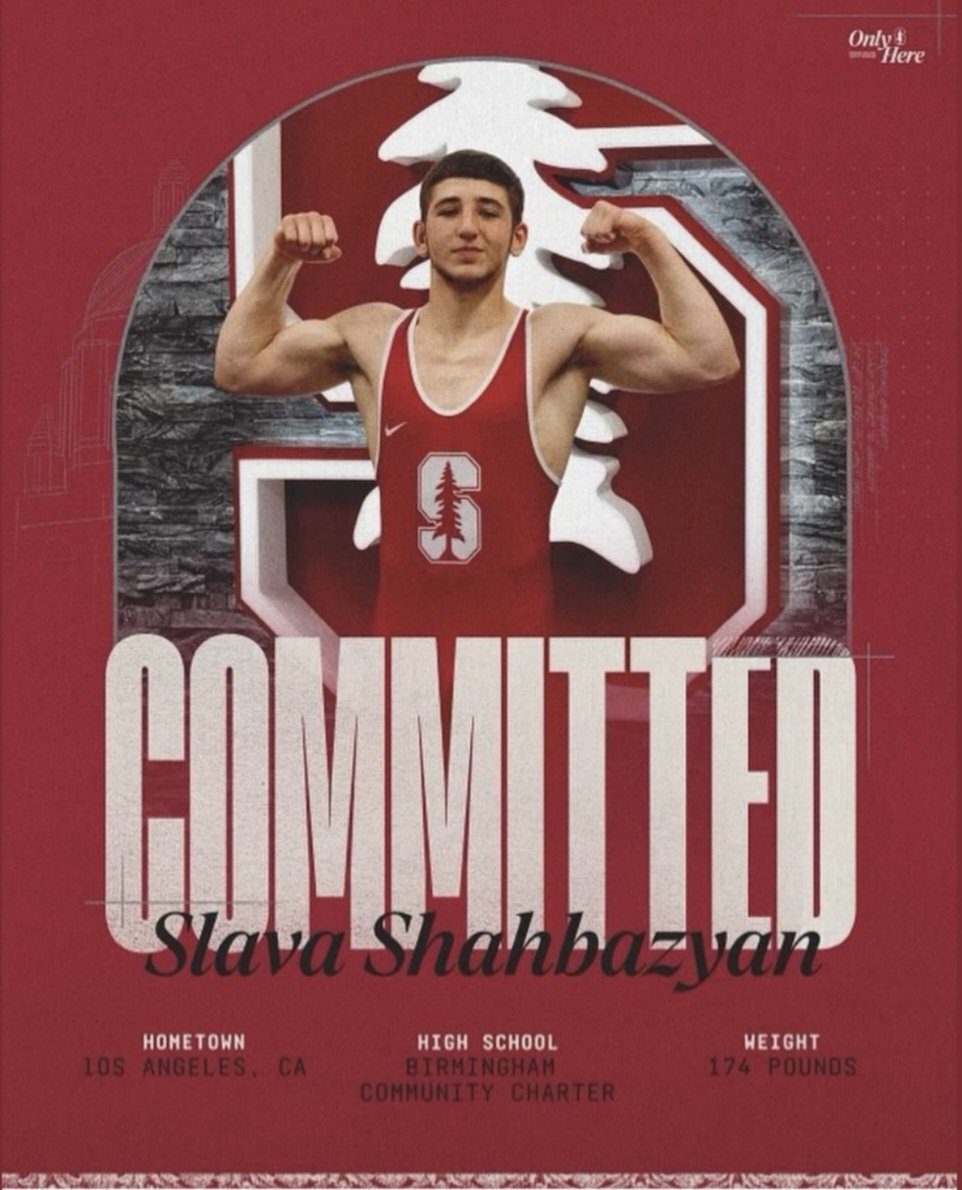

Slava Shahbazyan

Birmingham, California

Class of 2026

Committed to Stanford

Projected Weight: 174

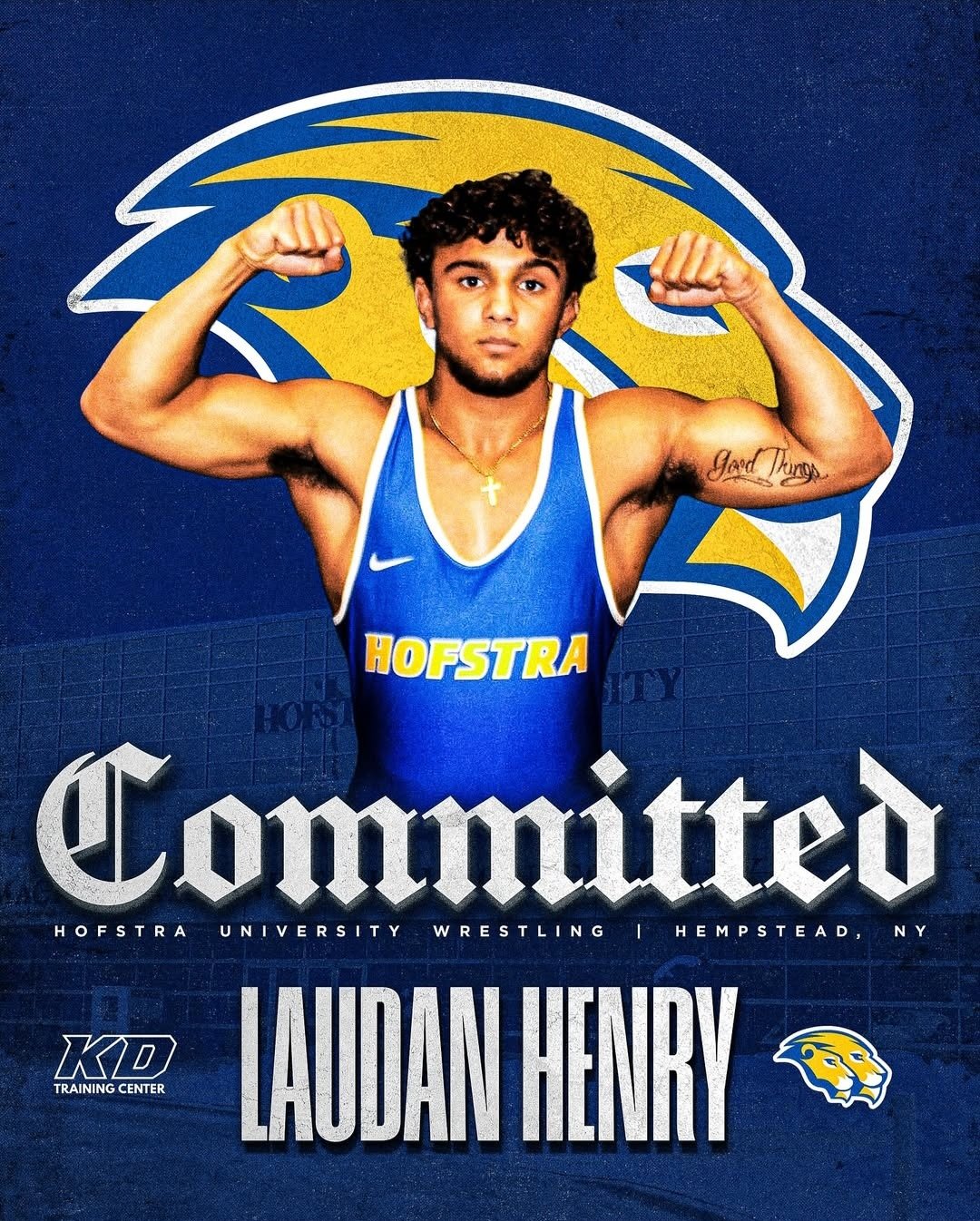

Laudan Henry

St. Peters Prep, New Jersey

Class of 2026

Committed to Hofstra

Projected Weight: 149

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now