California's wealth tax starts now !!!! Thats on top of the exorbitant taxes they already pay.

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

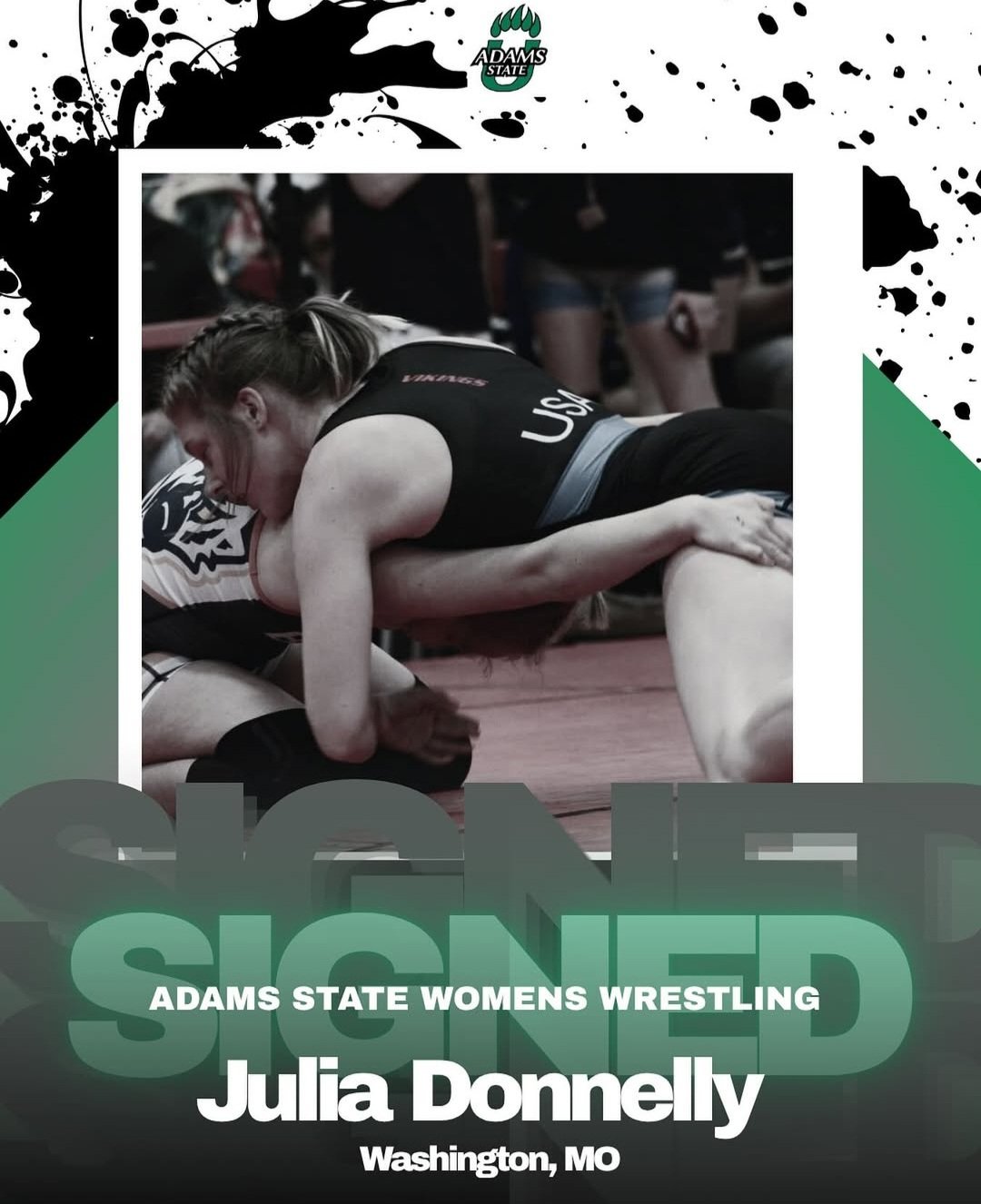

Julia Donnelly

Washington via Grand View, Missouri

Class of 2025

Committed to Adams State (Women)

Projected Weight: 117

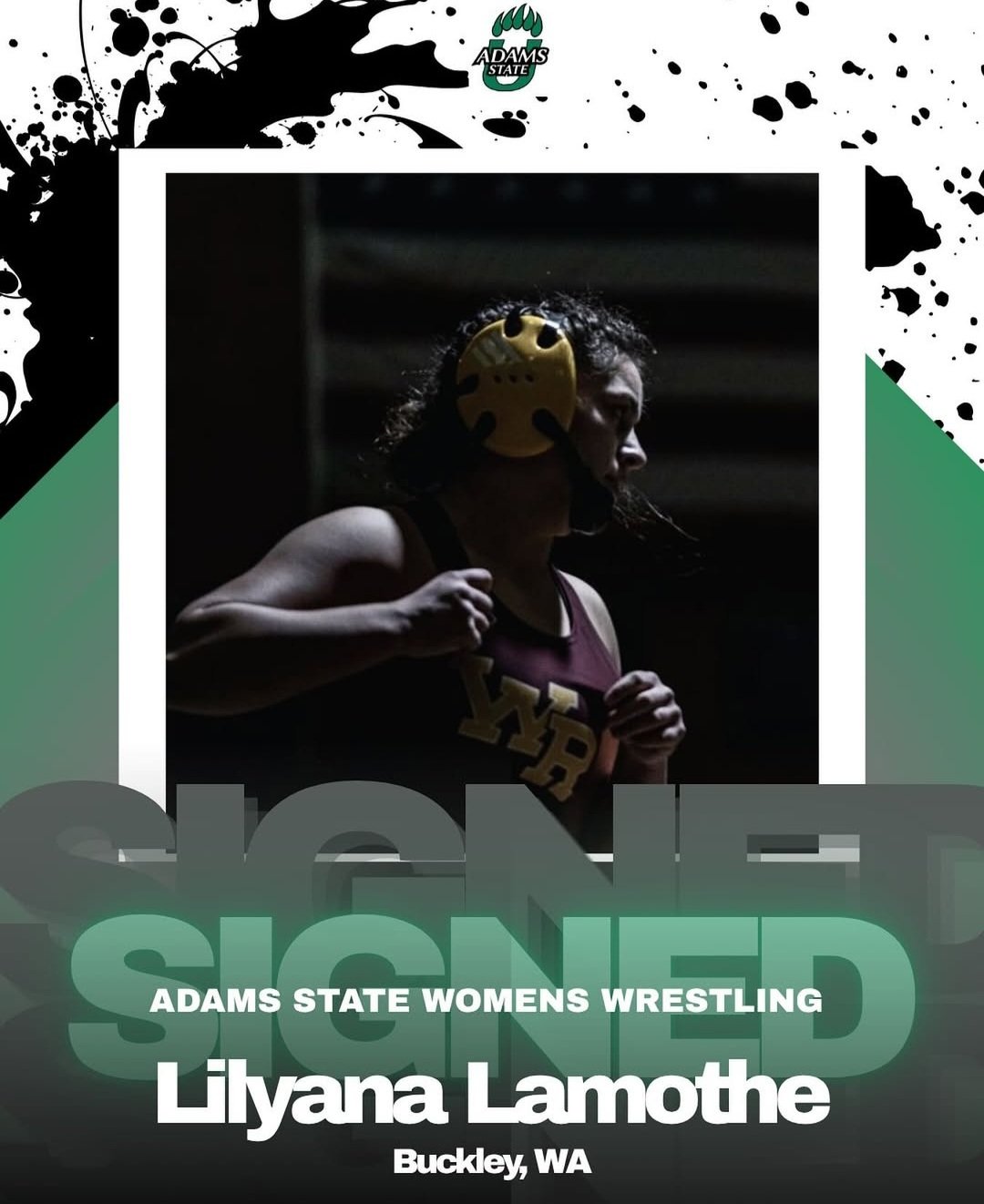

Lilyana Lamothe

White River, Washington

Class of 2025

Committed to Adams State (Women)

Projected Weight: 131

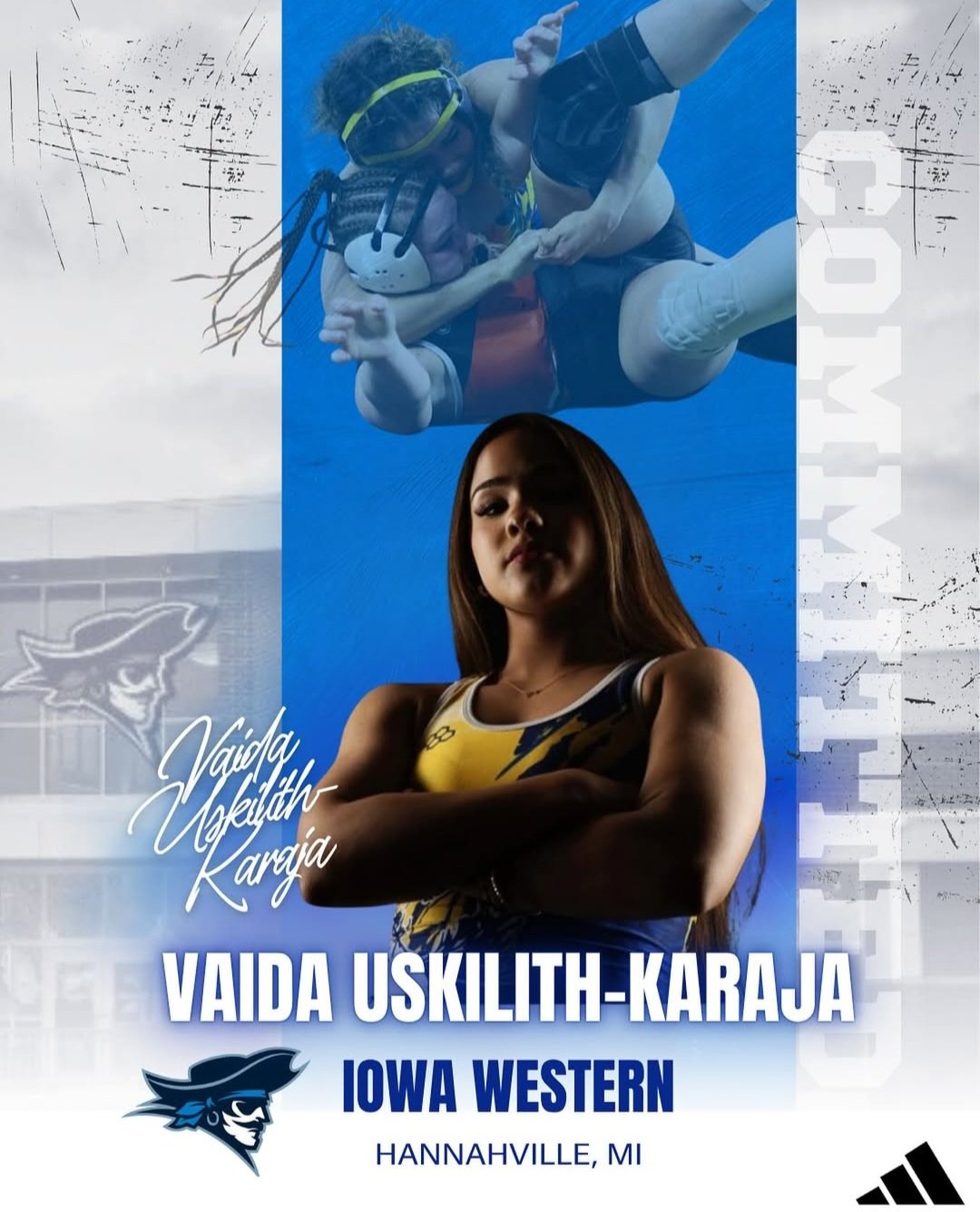

Vaida Uskilith-Karaja

Bark River-Harris, Michigan

Class of 2025

Committed to Iowa Western (Women)

Projected Weight: 138

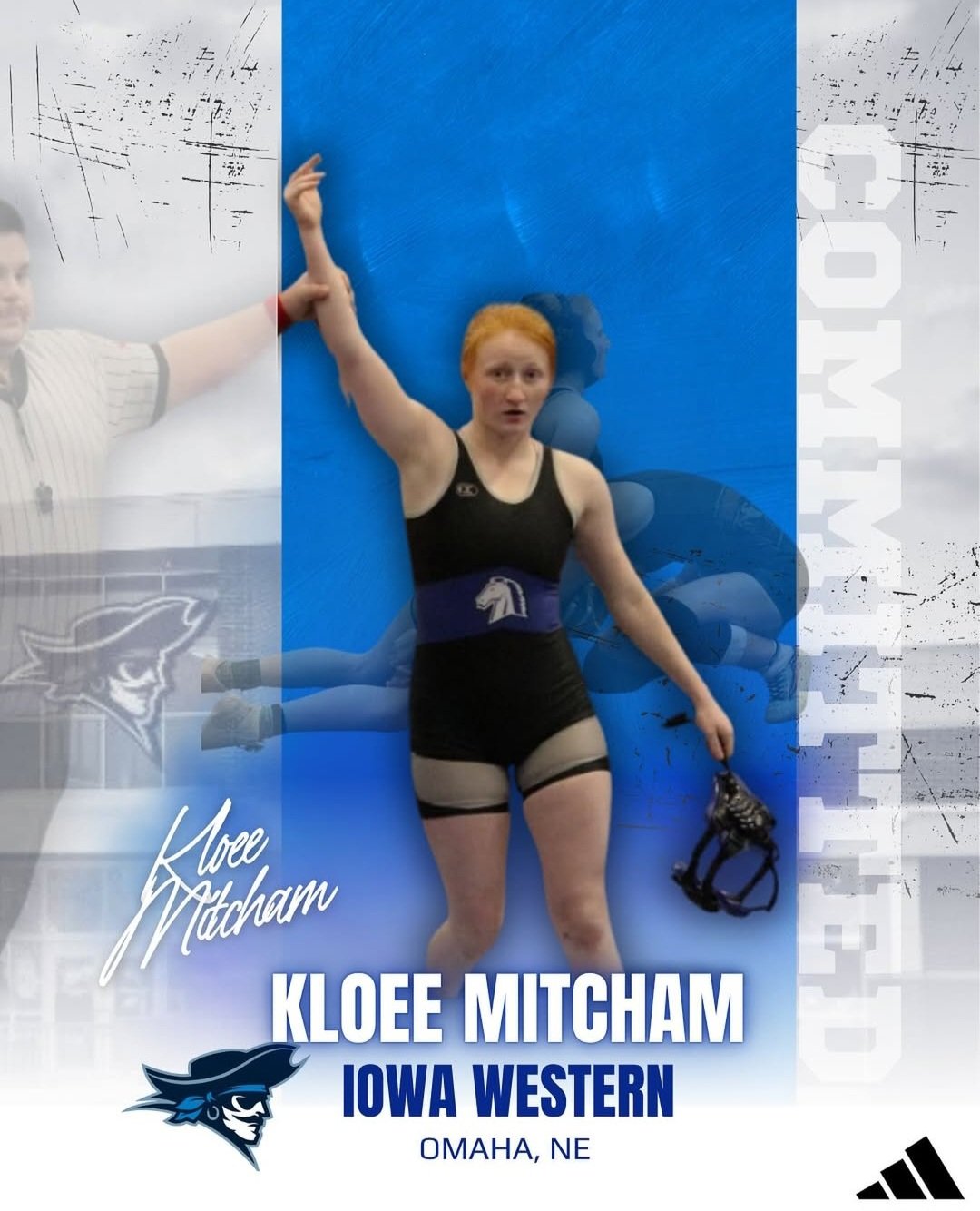

Kloee Mitcham

Millard North, Nebraska

Class of 2025

Committed to Iowa Western (Women)

Projected Weight: 124, 131

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now