Brian Thompson CEO of United Health Care was murdered (shot several times) by a hit man this morning on the streets in New York.

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

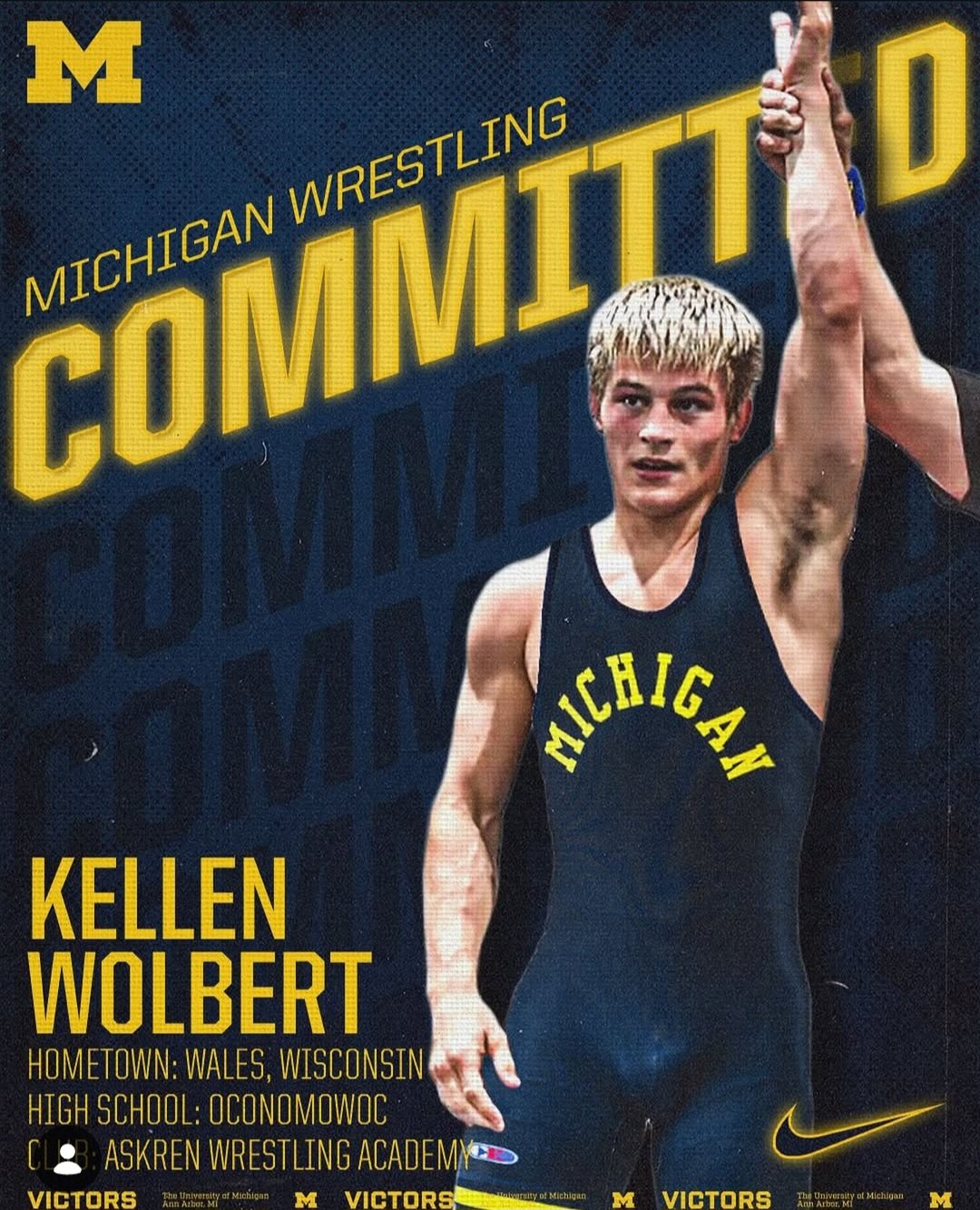

College Commitments

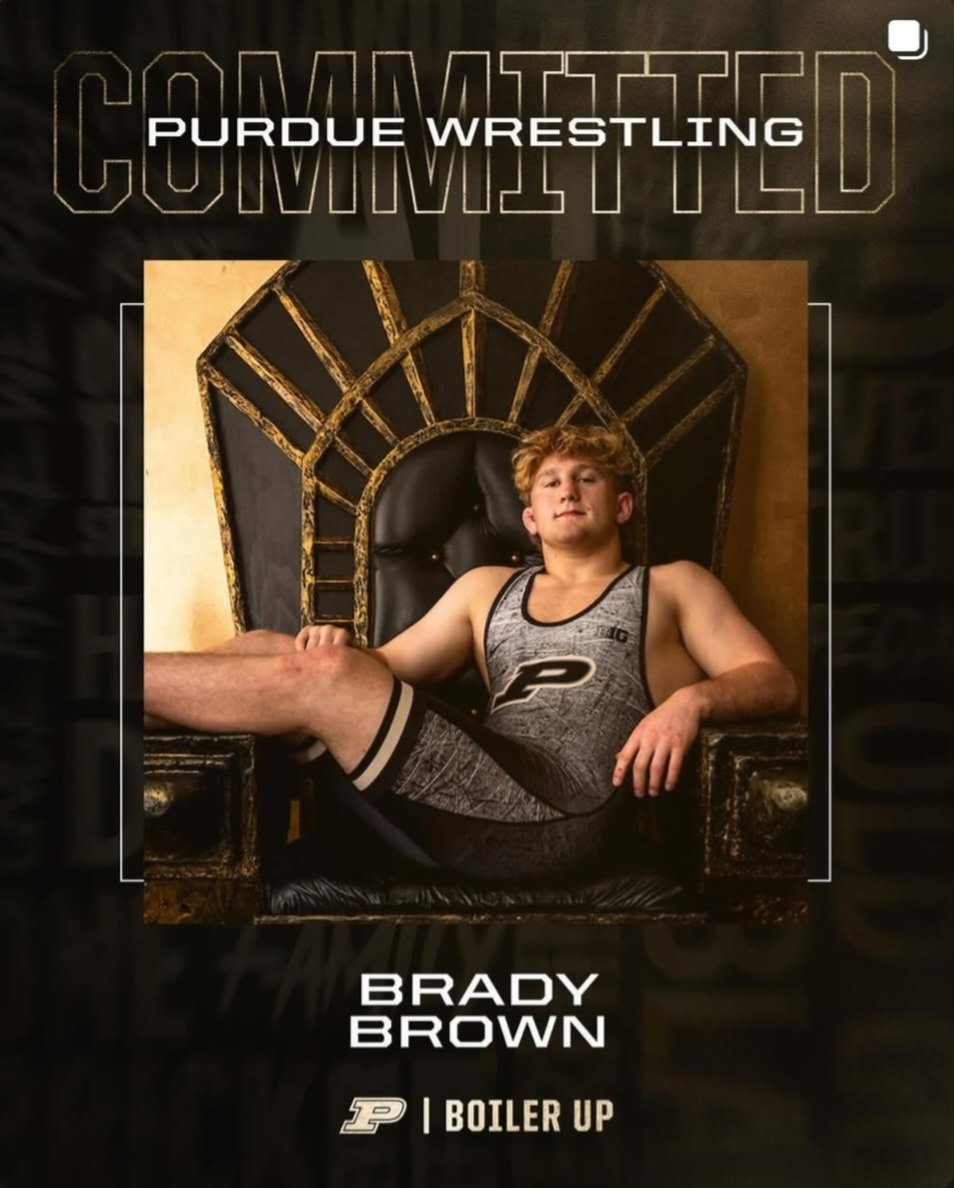

Brady Brown

Derry Area, Pennsylvania

Class of 2027

Committed to Purdue

Projected Weight: 197, 285

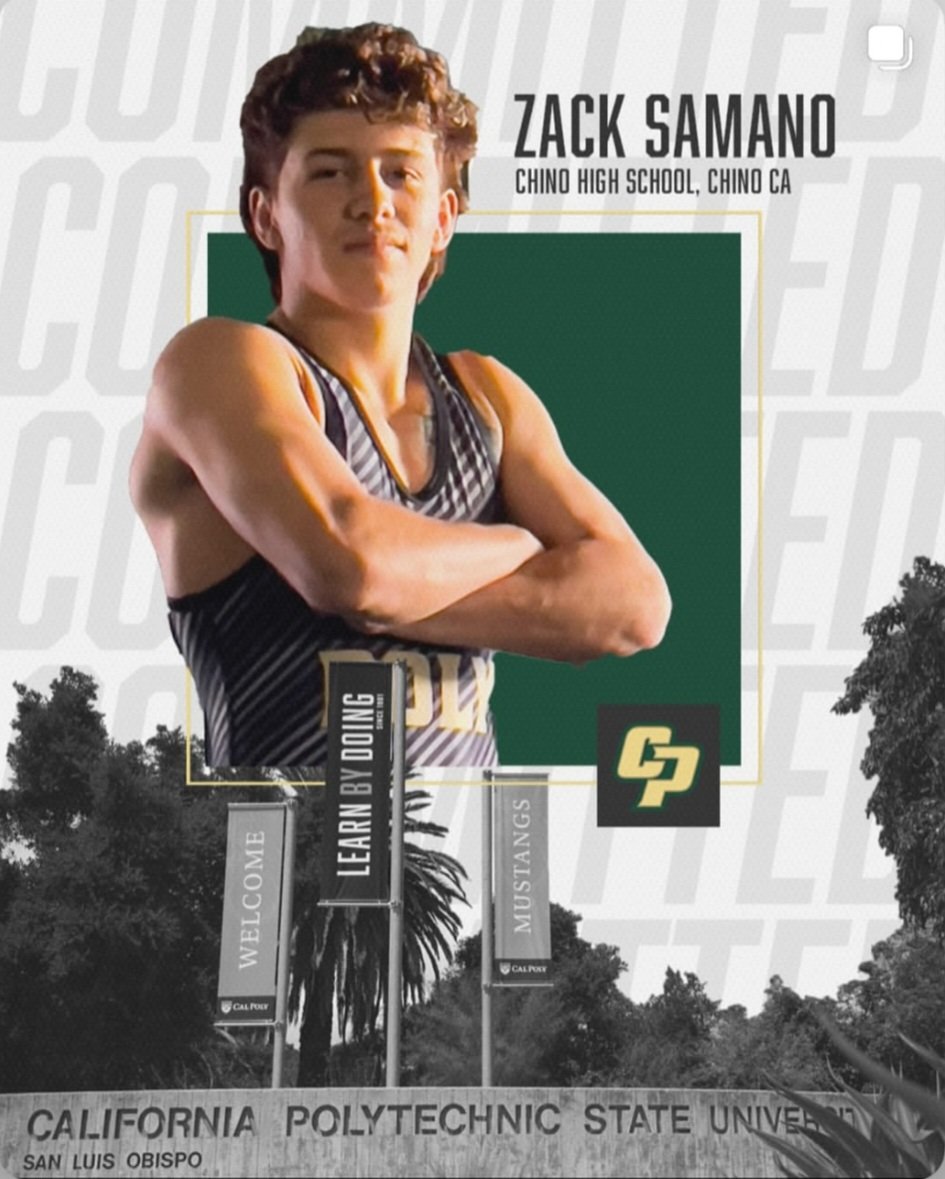

Zack Samano

Chino, California

Class of 2027

Committed to Cal Poly

Projected Weight: 125

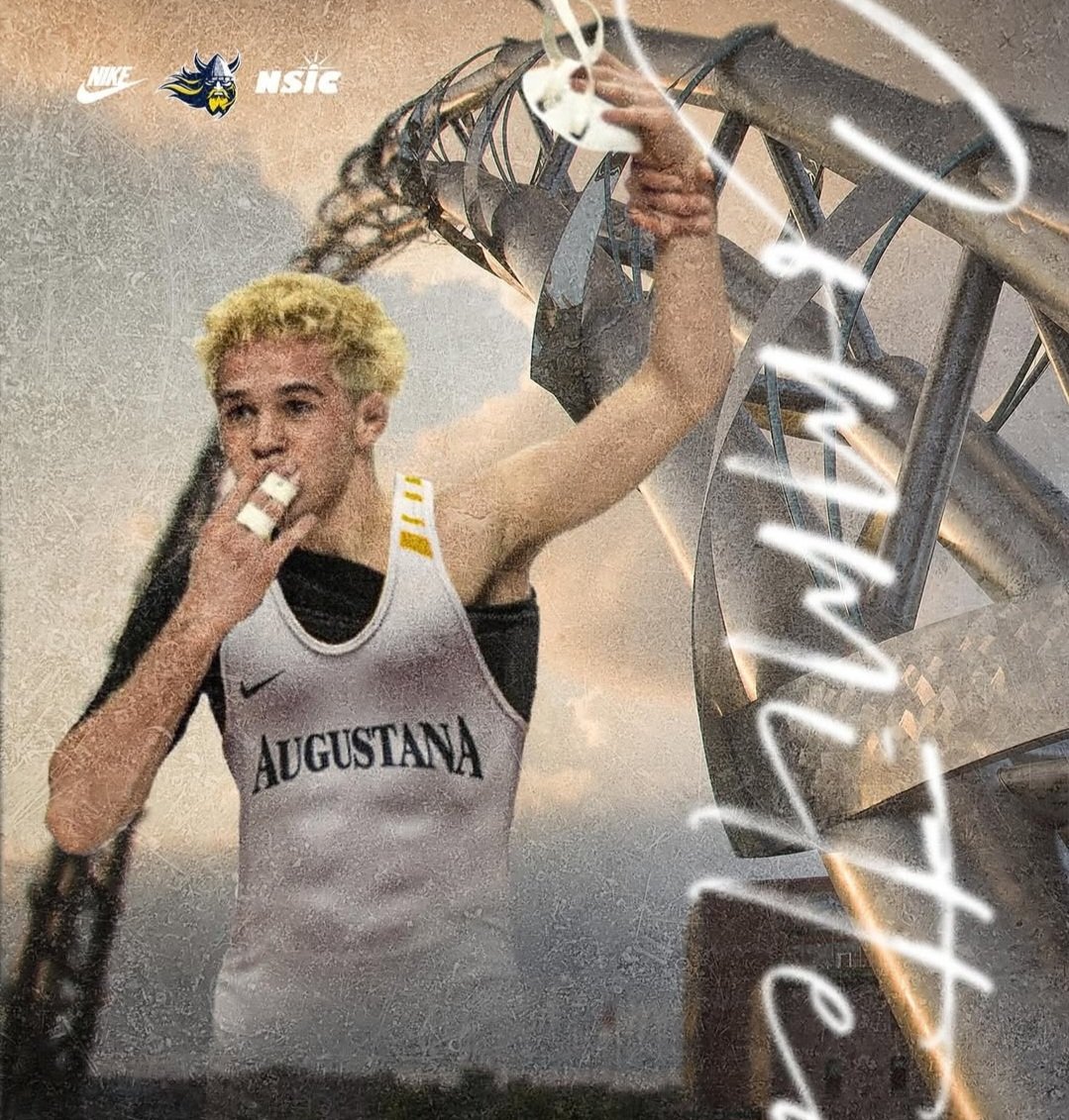

Shea Richter

Watertown, South Dakota

Class of 2026

Committed to Augustana (SD)

Projected Weight: 125, 133

Trey Craig

Christian Brothers, Missouri

Class of 2026

Committed to Missouri

Projected Weight: 197

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now