Climate Hoax

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

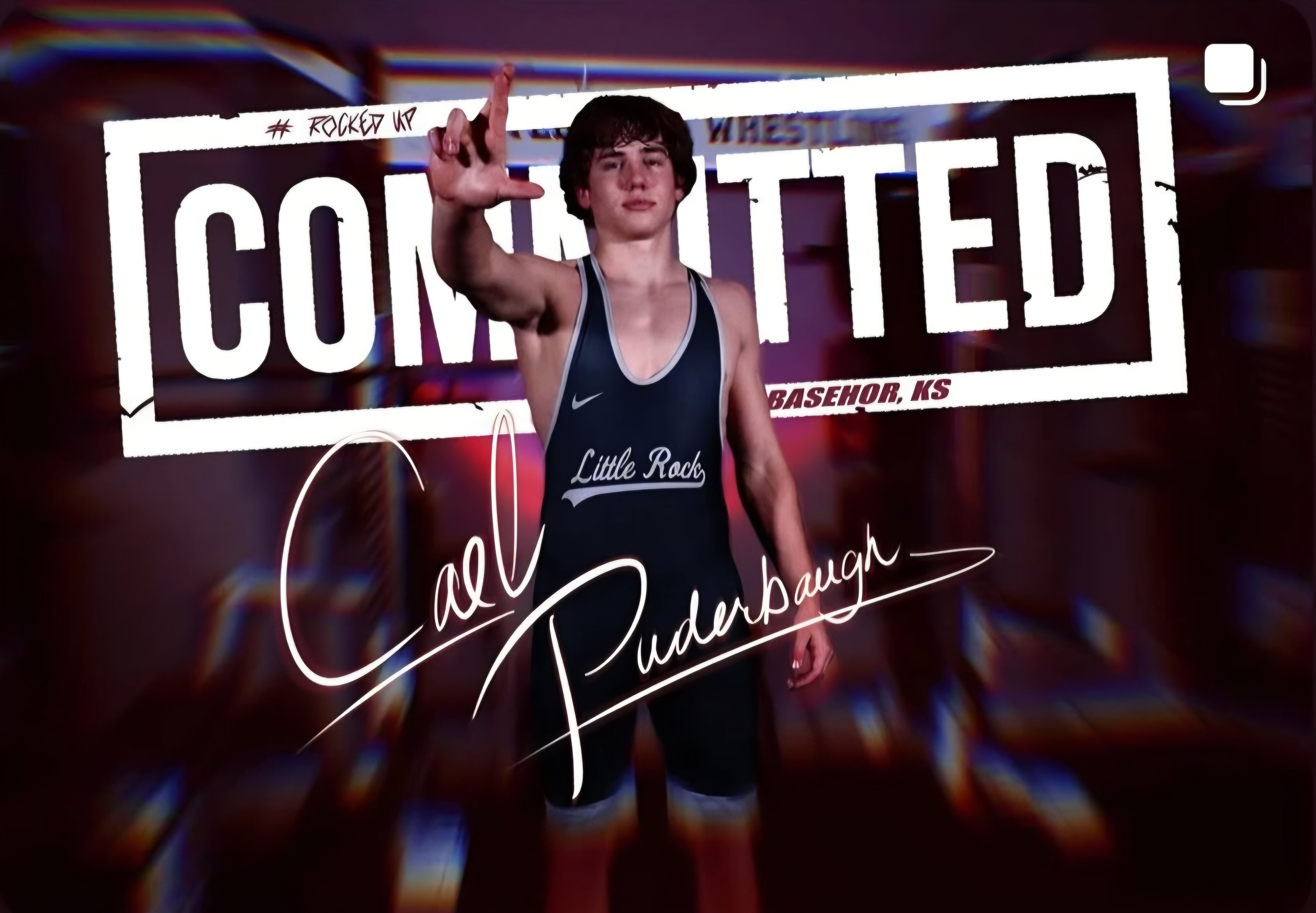

Cael Puderbaugh

Basehor-Linwood, Kansas

Class of 2027

Committed to Little Rock

Projected Weight: 141

Caroline Collins

Carlsbad, California

Class of 2026

Committed to Dakota Wesleyan (Women)

Projected Weight: 110

JaeLeigh Miller

Lyons-Decatur, Nebraska

Class of 2026

Committed to Dakota Wesleyan (Women)

Projected Weight: 207

Morghan Barna

Laurel, Montana

Class of 2026

Committed to Dakota Wesleyan (Women)

Projected Weight: 131

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now