Twitter is better

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

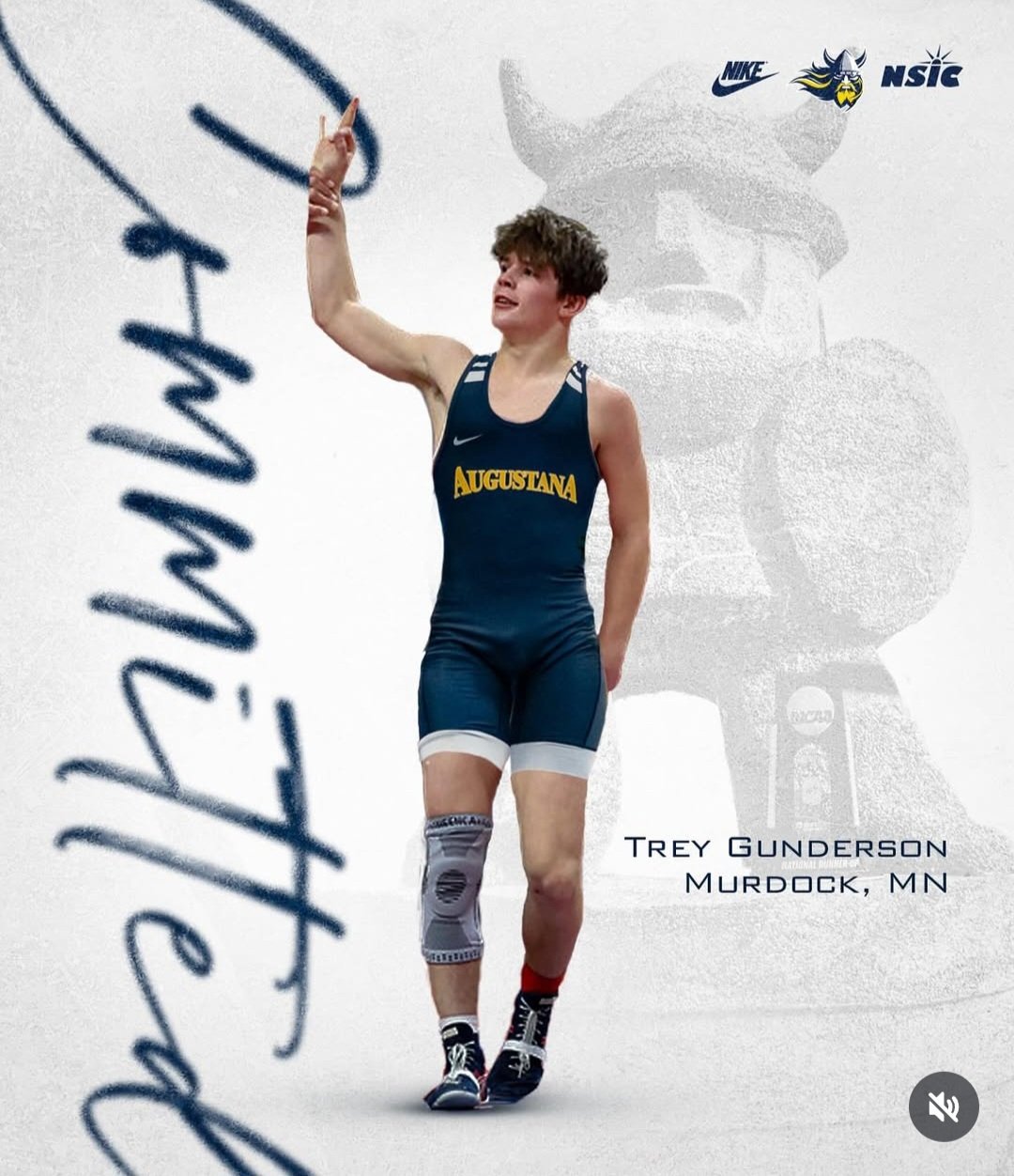

Trey Gunderson

Kerkhoven-Murdock-Sunburg, Minnesota

Class of 2026

Committed to Augustana (SD)

Projected Weight: 149

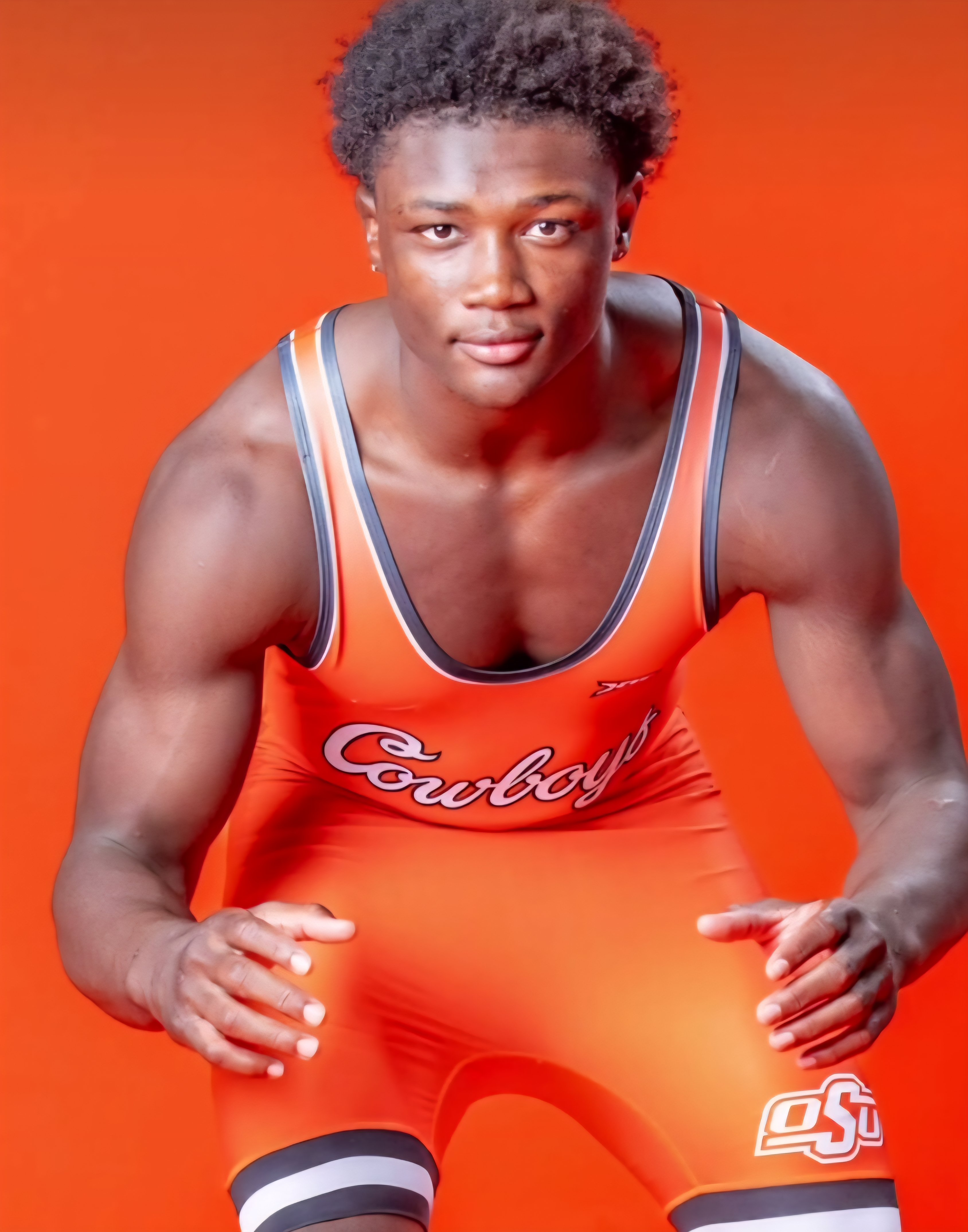

Michael White

Lawrence North, Indiana

Class of 2026

Committed to Oklahoma State

Projected Weight: 184, 197

Bryce Schnelzer

Loudoun County, Virginia

Class of 2026

Committed to Clarion

Projected Weight: 133, 141

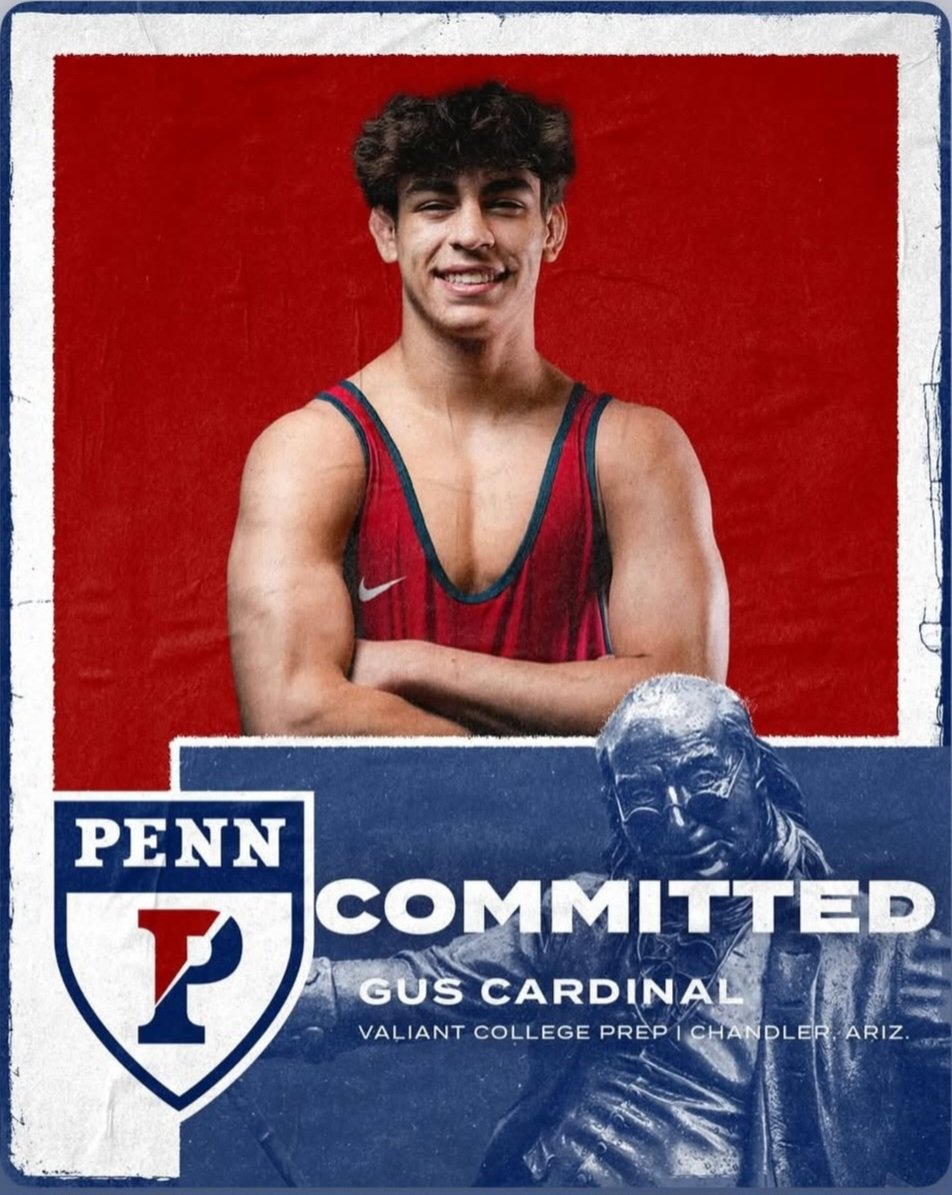

Gus Cardinal

Valiant Prep, Arizona

Class of 2026

Committed to Penn

Projected Weight: 149, 157

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now