Stock Investing and Recession

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

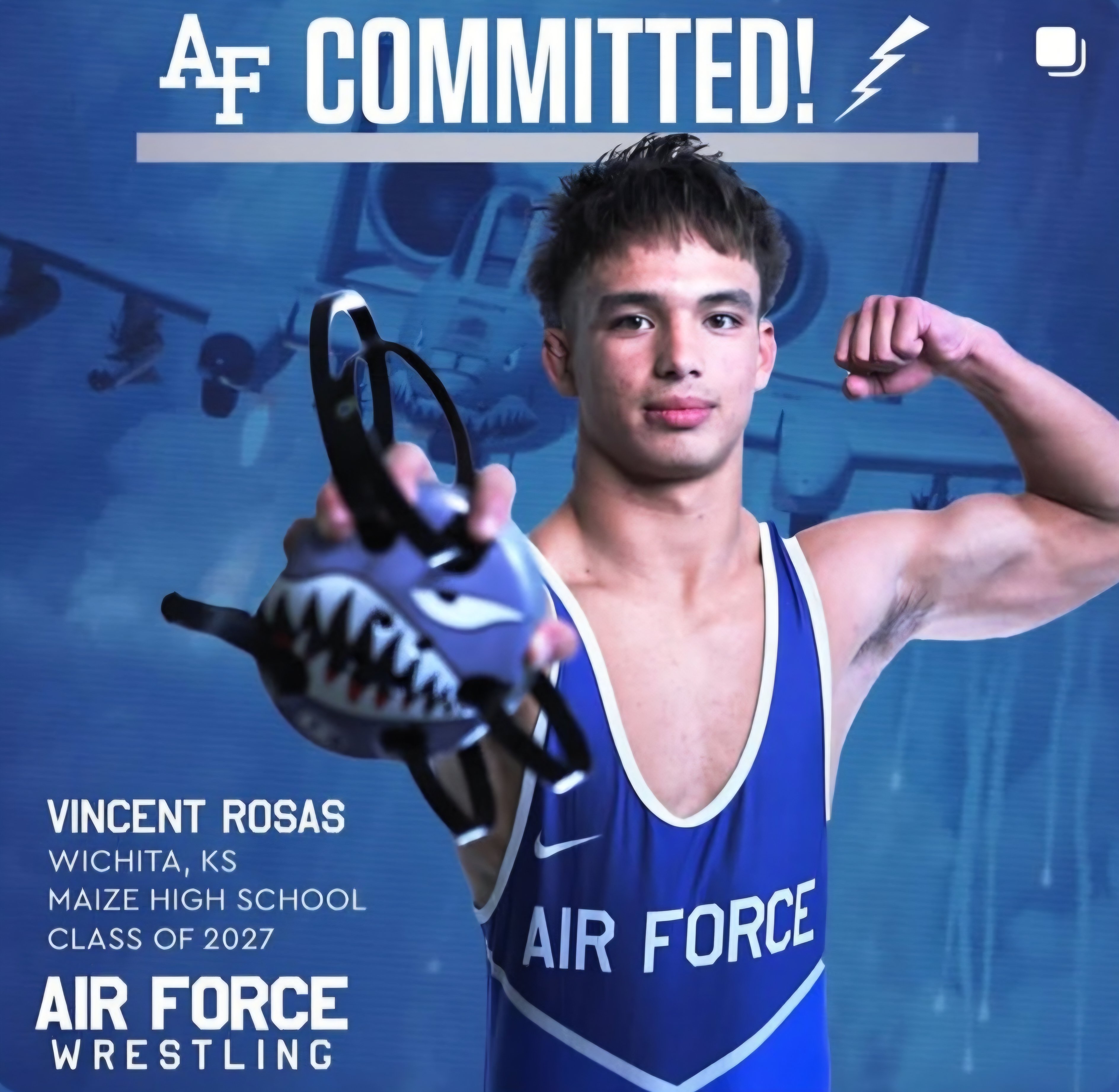

Vincent Rosas

Maize, Kansas

Class of 2027

Committed to Air Force

Projected Weight: 141, 149

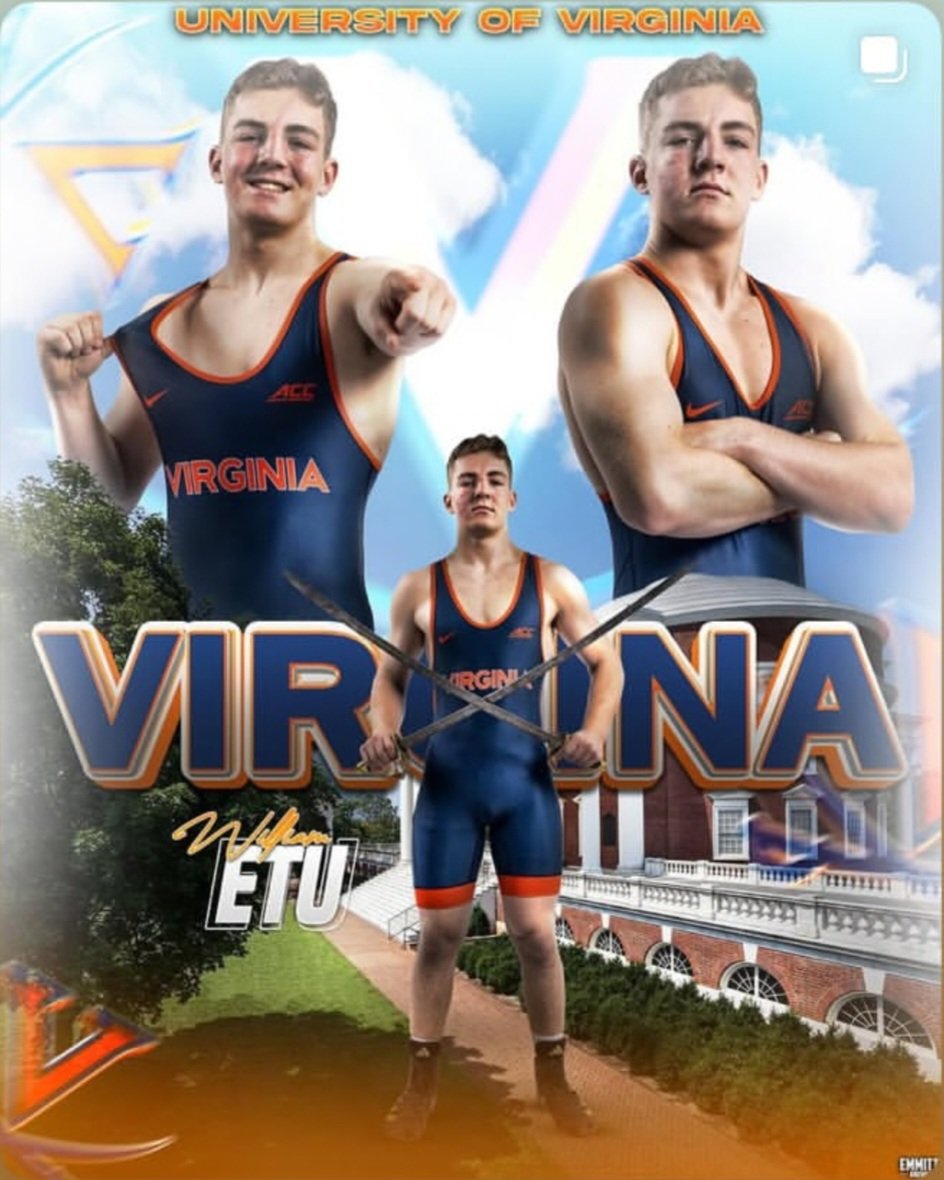

Will Etu

Stafford, Virginia

Class of 2026

Committed to Virginia

Projected Weight: 184, 197

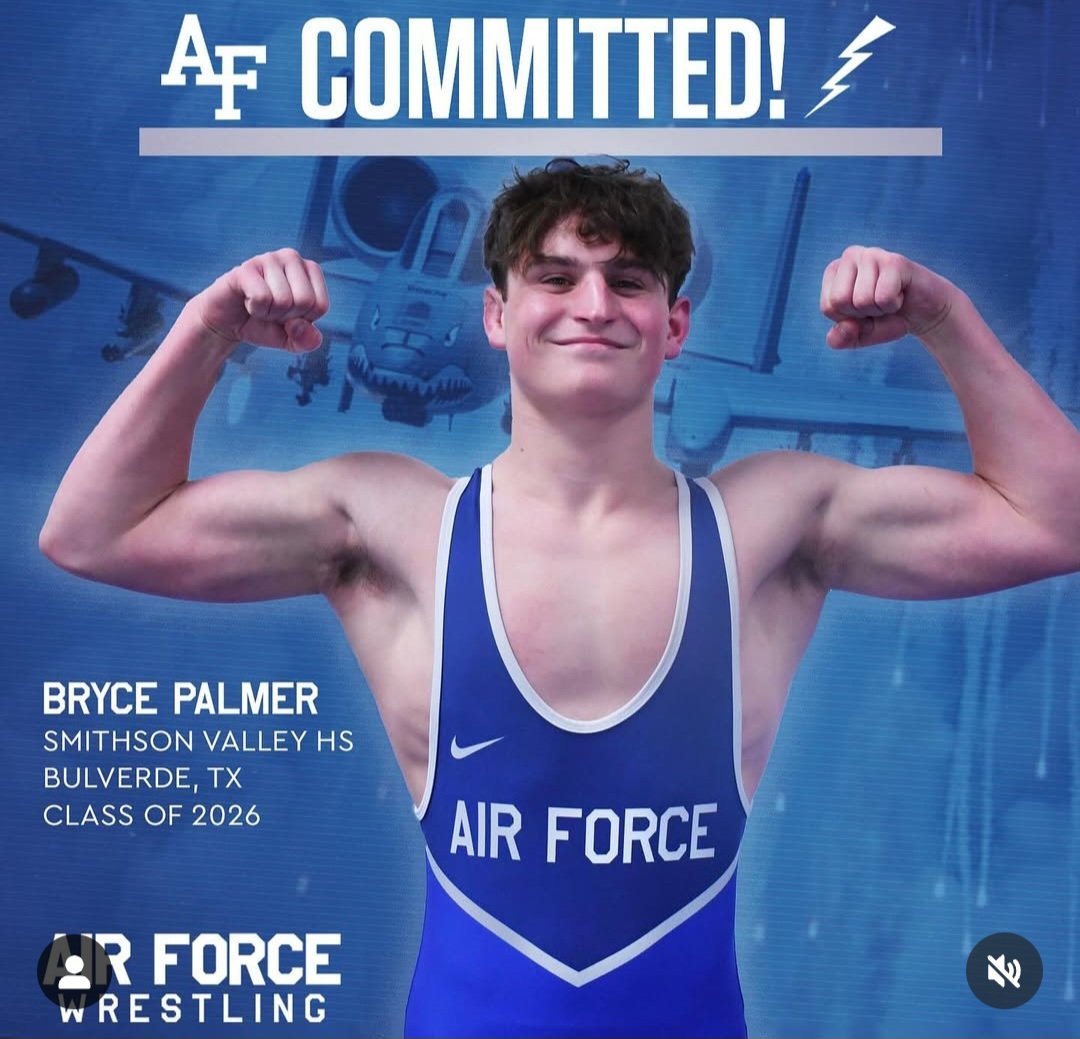

Bryce Palmer

Smithson Valley, Texas

Class of 2026

Committed to Air Force

Projected Weight: 157

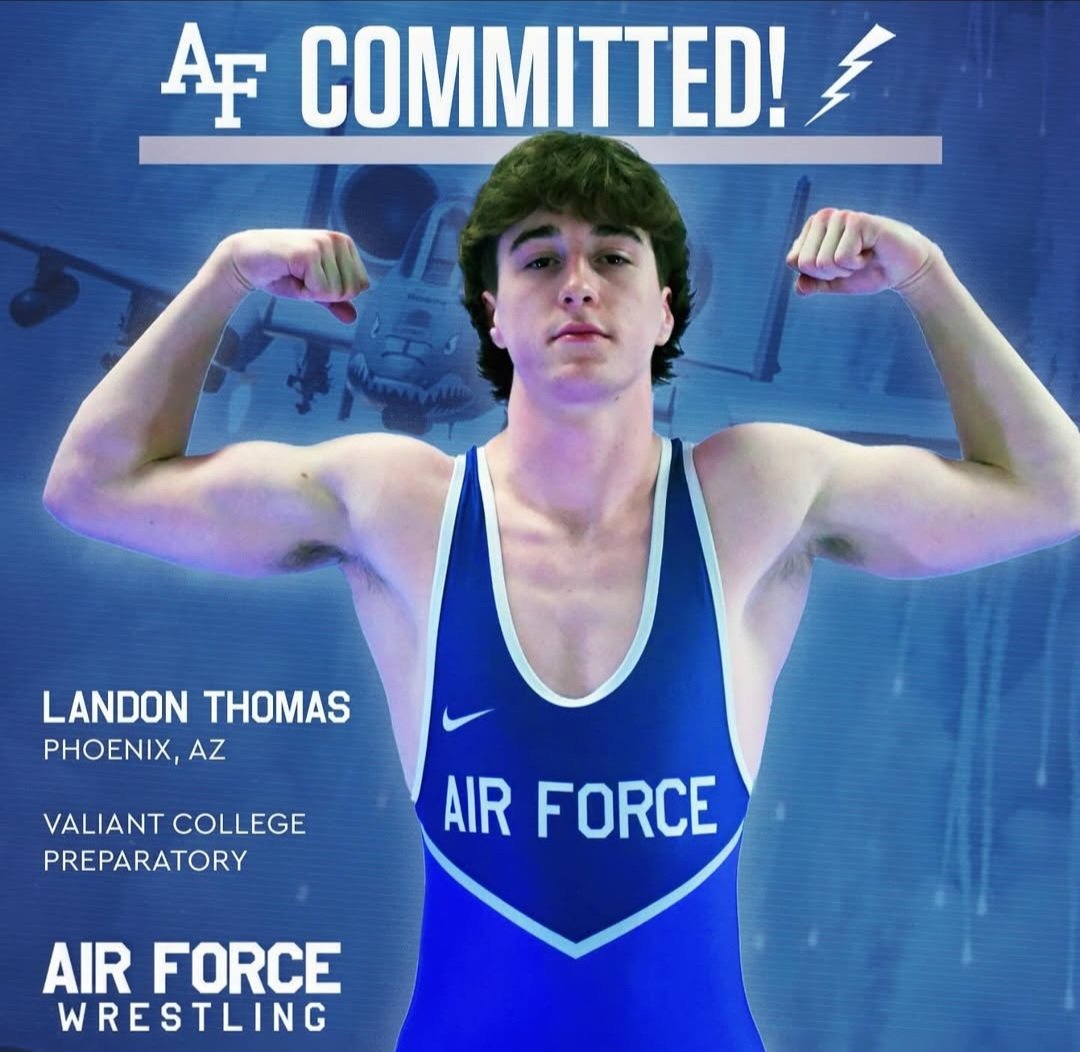

Landon Thomas

Valiant Prep, Arizona

Class of 2026

Committed to Air Force

Projected Weight: 141

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now