The Government can’t give someone something without first taking it from someone else

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

Brett Crawford

St Anthony’s, New York

Class of 2026

Committed to Mercyhurst

Projected Weight: 125

Hayden myers

St Paul's, Maryland

Class of 2026

Committed to Mercyhurst

Projected Weight: 184, 197

Jake Hill

Elyria Catholic, Ohio

Class of 2026

Committed to Mercyhurst

Projected Weight: 157, 165

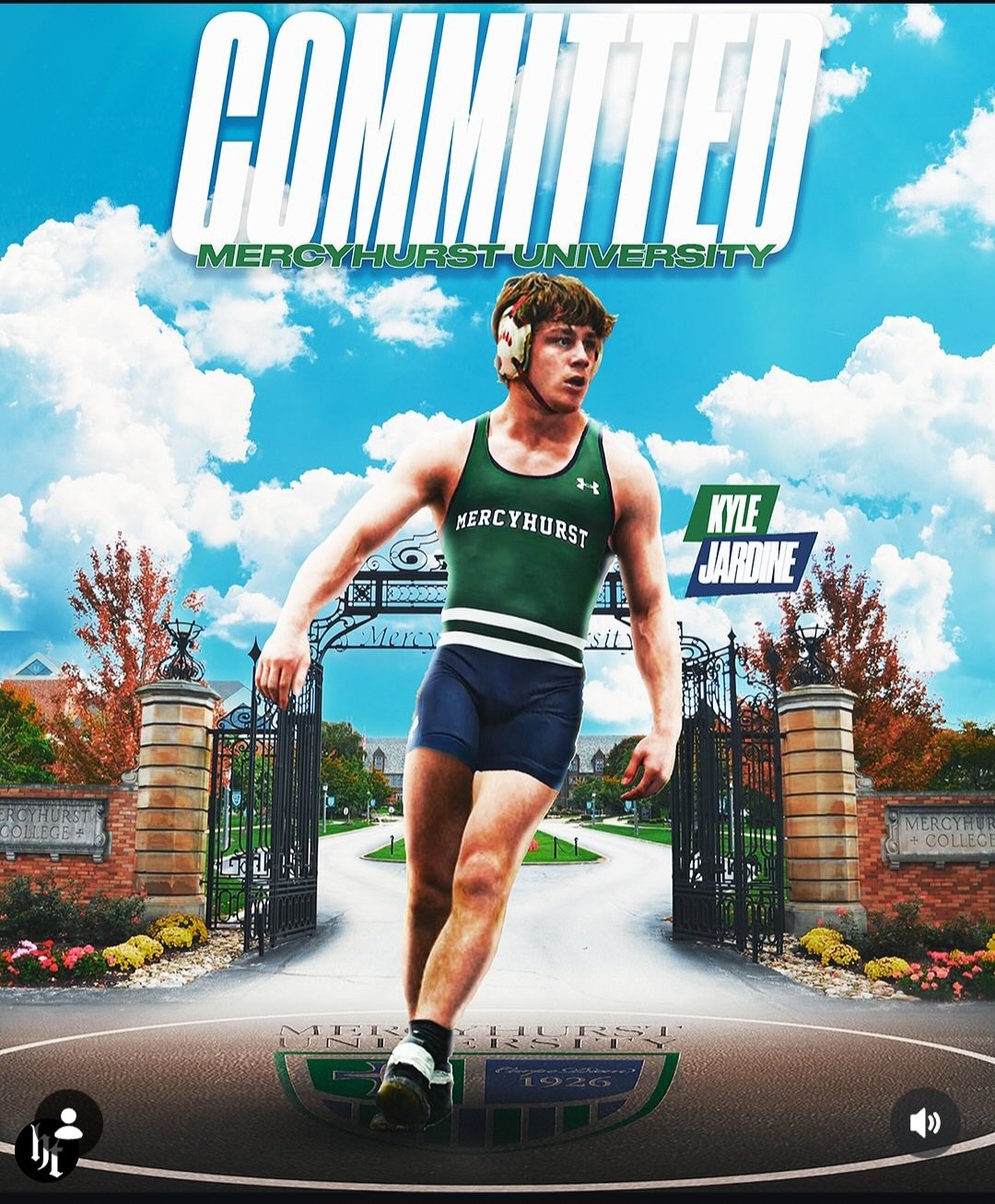

Kyle Jardine

Wadsworth, Ohio

Class of 2026

Committed to Mercyhurst

Projected Weight: 149, 157

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now