How Good Are Experts at Predicting the Stock Market?

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

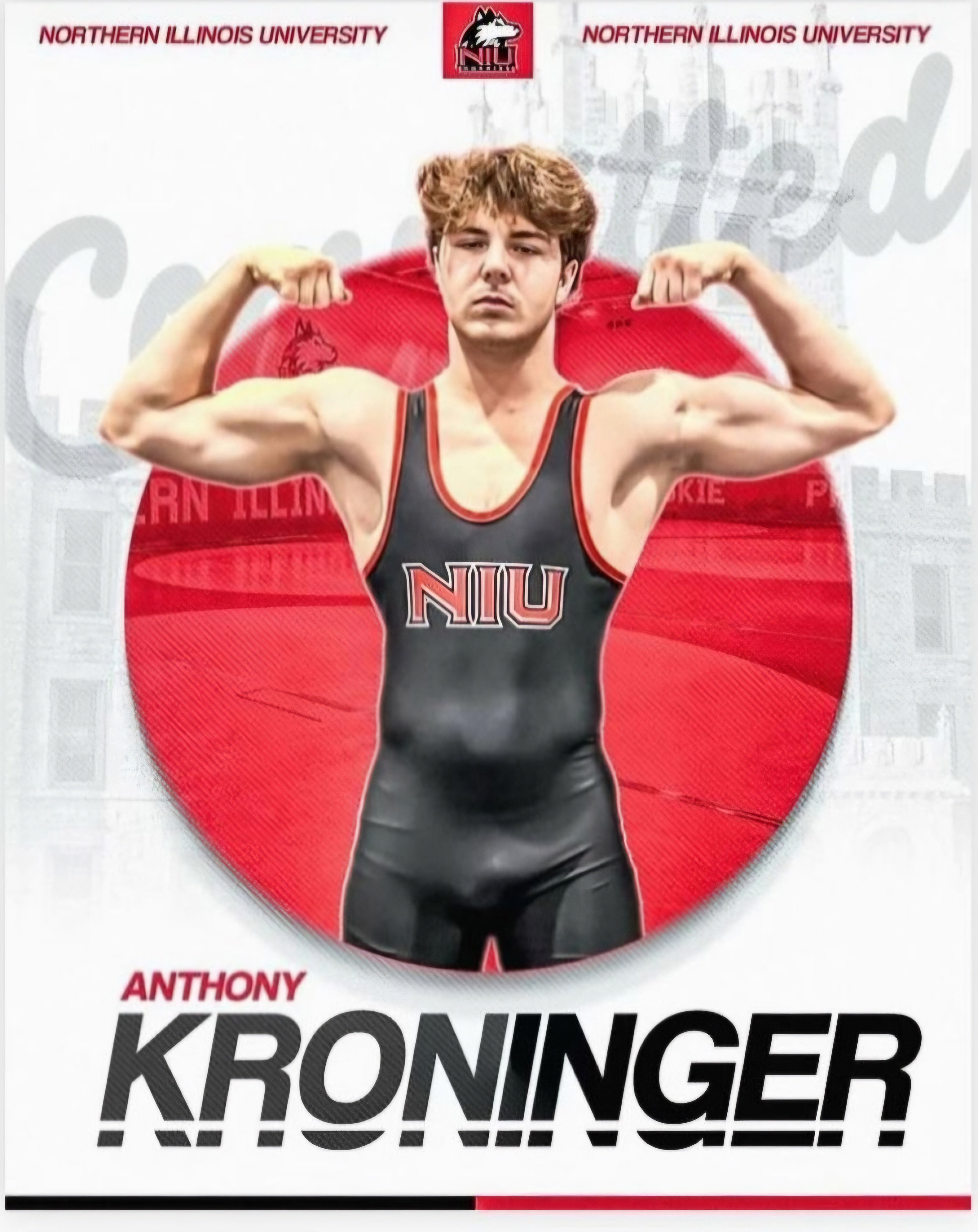

Anthony Kroninger

Alder, Ohio

Class of 2025

Committed to Northern Illinois

Projected Weight: 174

Cooper Foster

Avery County, North Carolina

Class of 2025

Committed to Appalachian State

Projected Weight: 125

Katie Simmons

Laney, North Carolina

Class of 2025

Committed to Mount Olive (Women)

Projected Weight: 110, 117

Roman Belardo

Jefferson, Georgia

Class of 2026

Committed to Hofstra

Projected Weight: 133

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now