Stock Investing and Recession

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

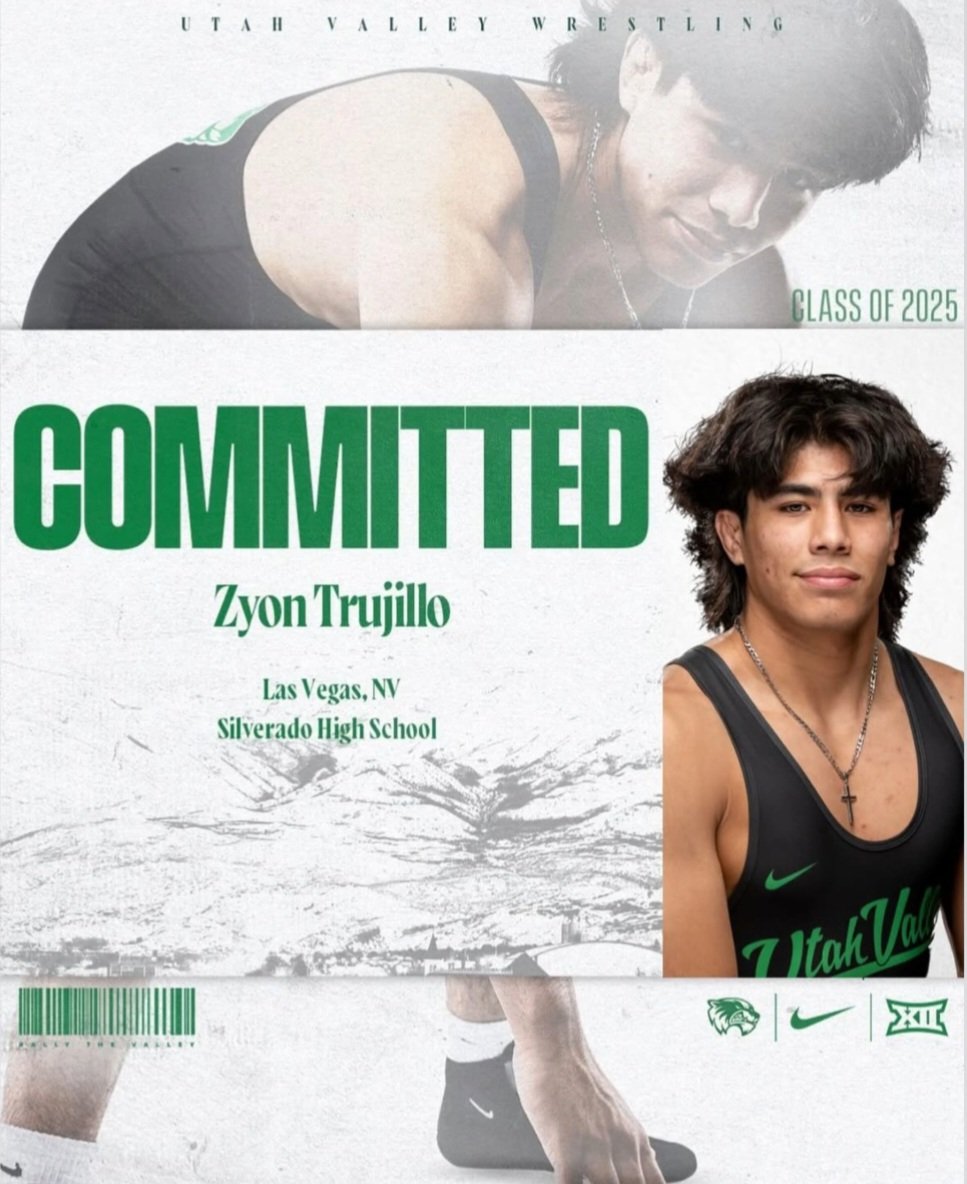

Zyon Trujillo

Silverado, Nevada

Class of 2025

Committed to Utah Valley

Projected Weight: 174

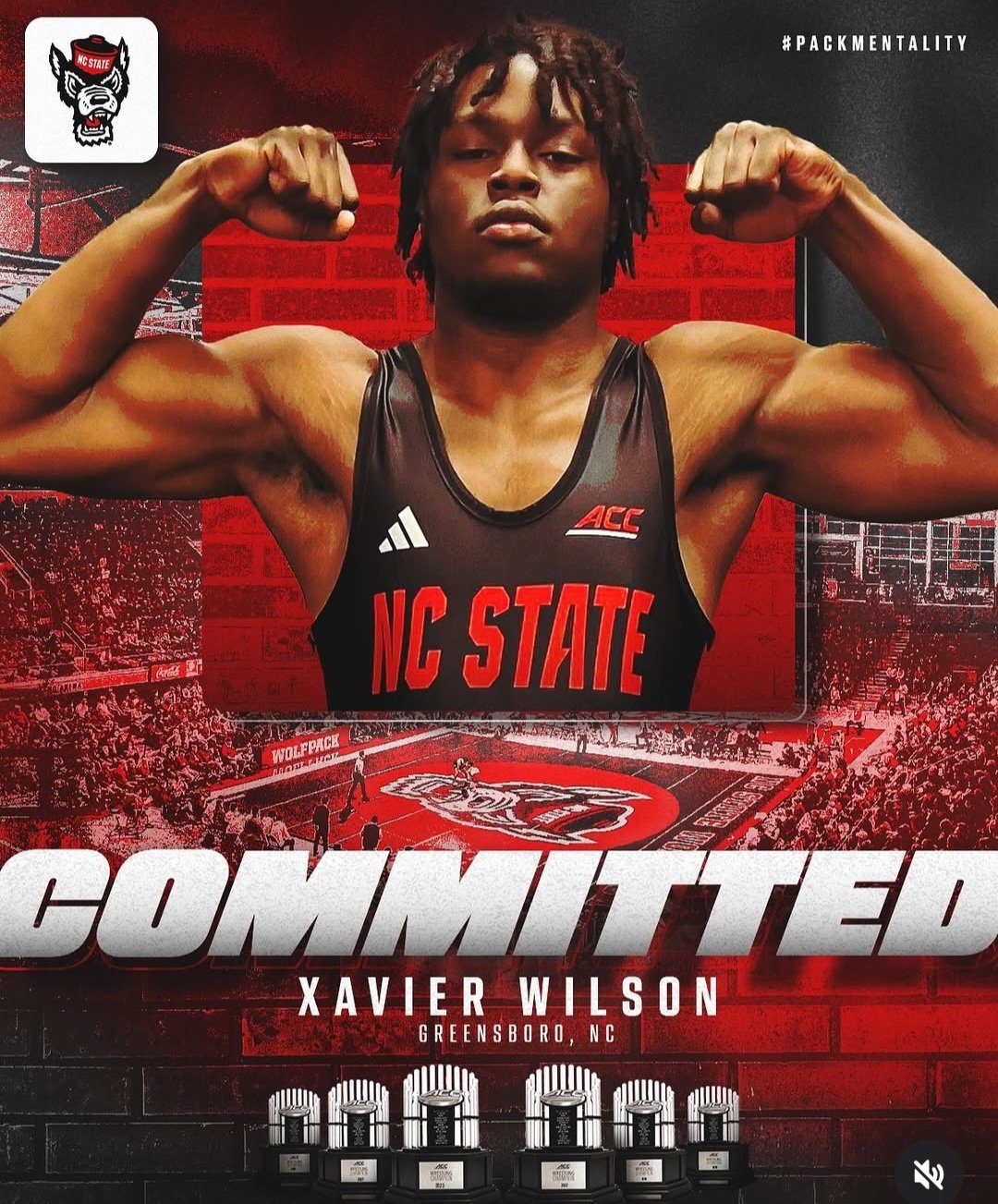

Xavier Wilson

Eastern Guilford, North Carolina

Class of 2025

Committed to North Carolina State

Projected Weight: 197, 285

Cooper Hinz

Jesup, Iowa

Class of 2026

Committed to Michigan

Projected Weight: 125, 133

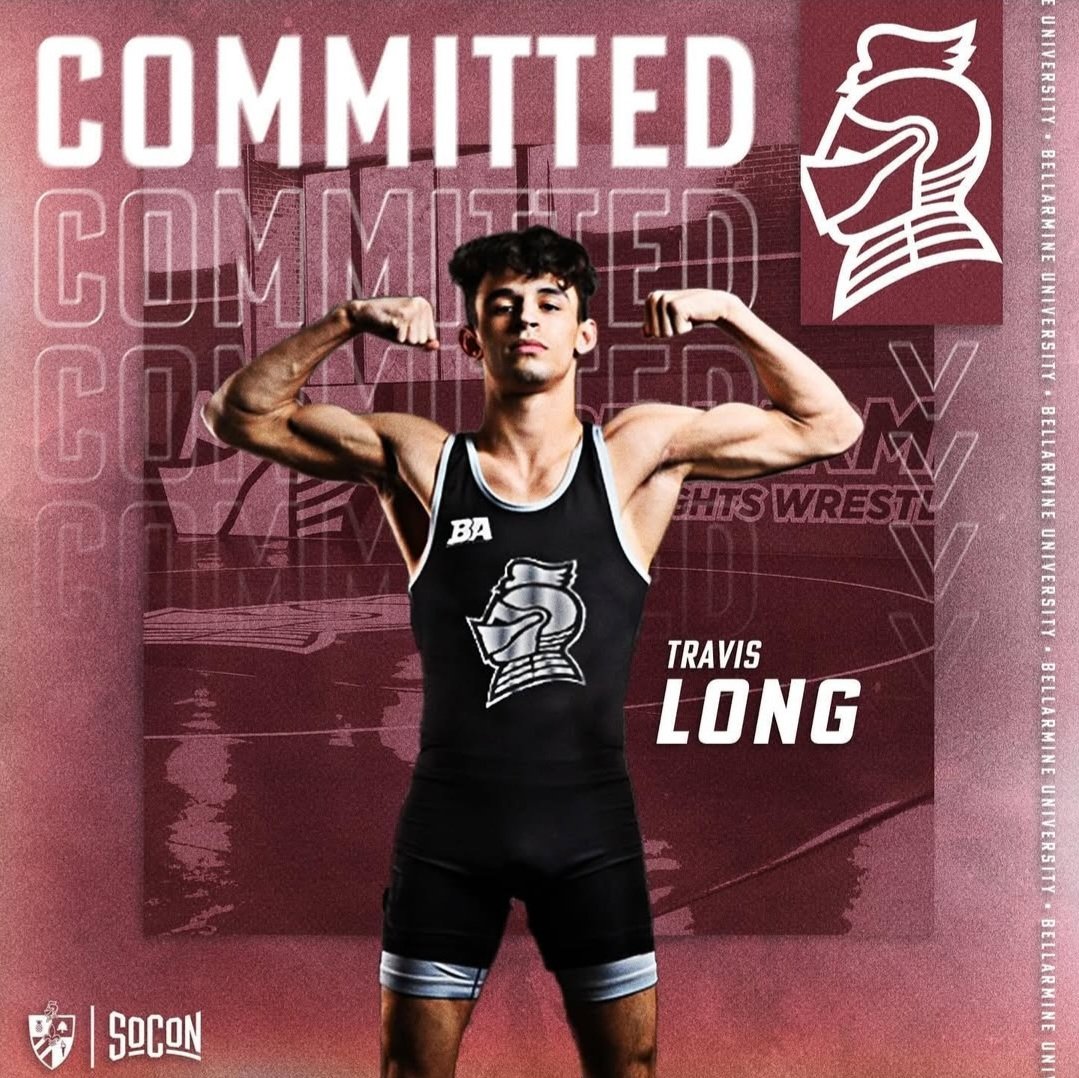

Isaac Johns

Woodford County, Kentucky

Class of 2025

Committed to Bellarmine

Projected Weight: 149, 157

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now