Hyperinflationary Policies of Trump

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

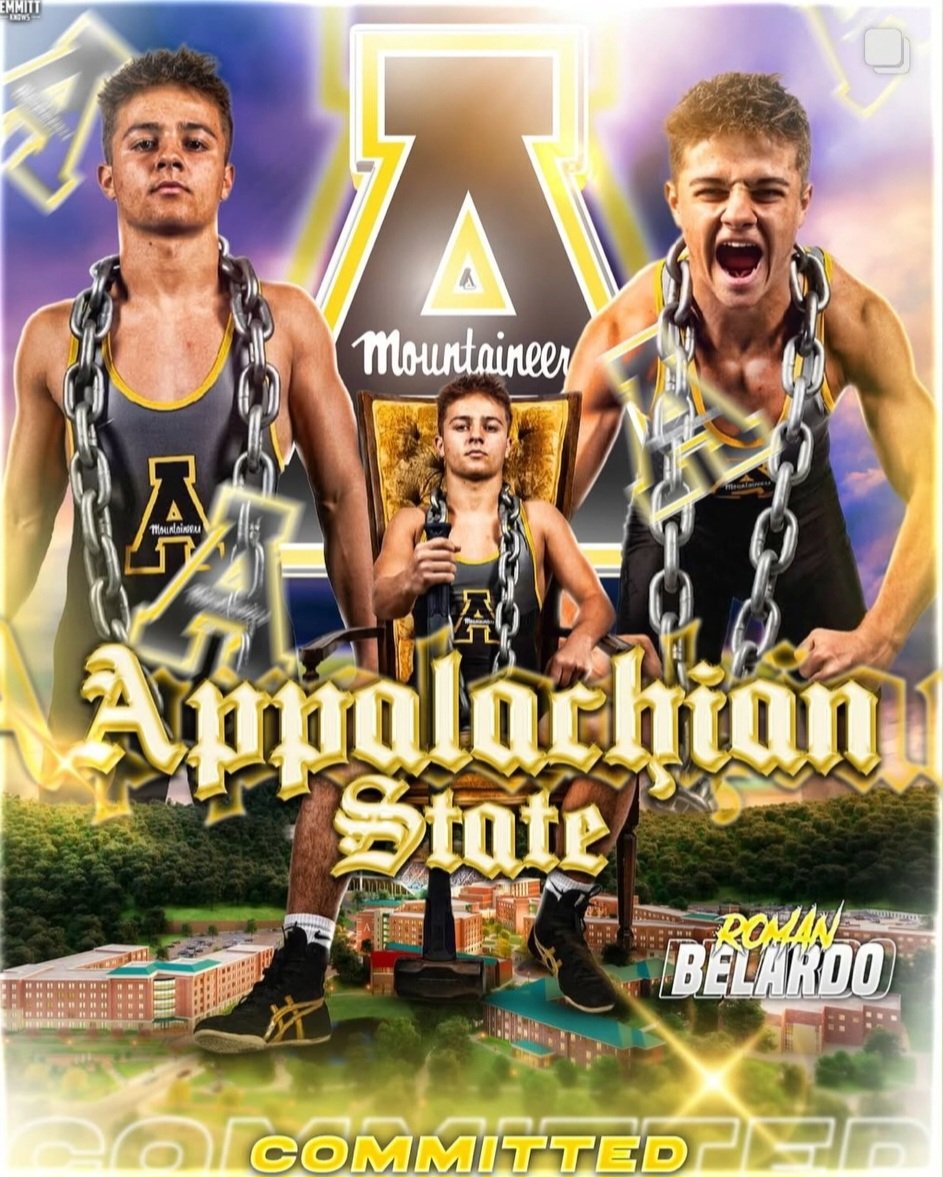

College Commitments

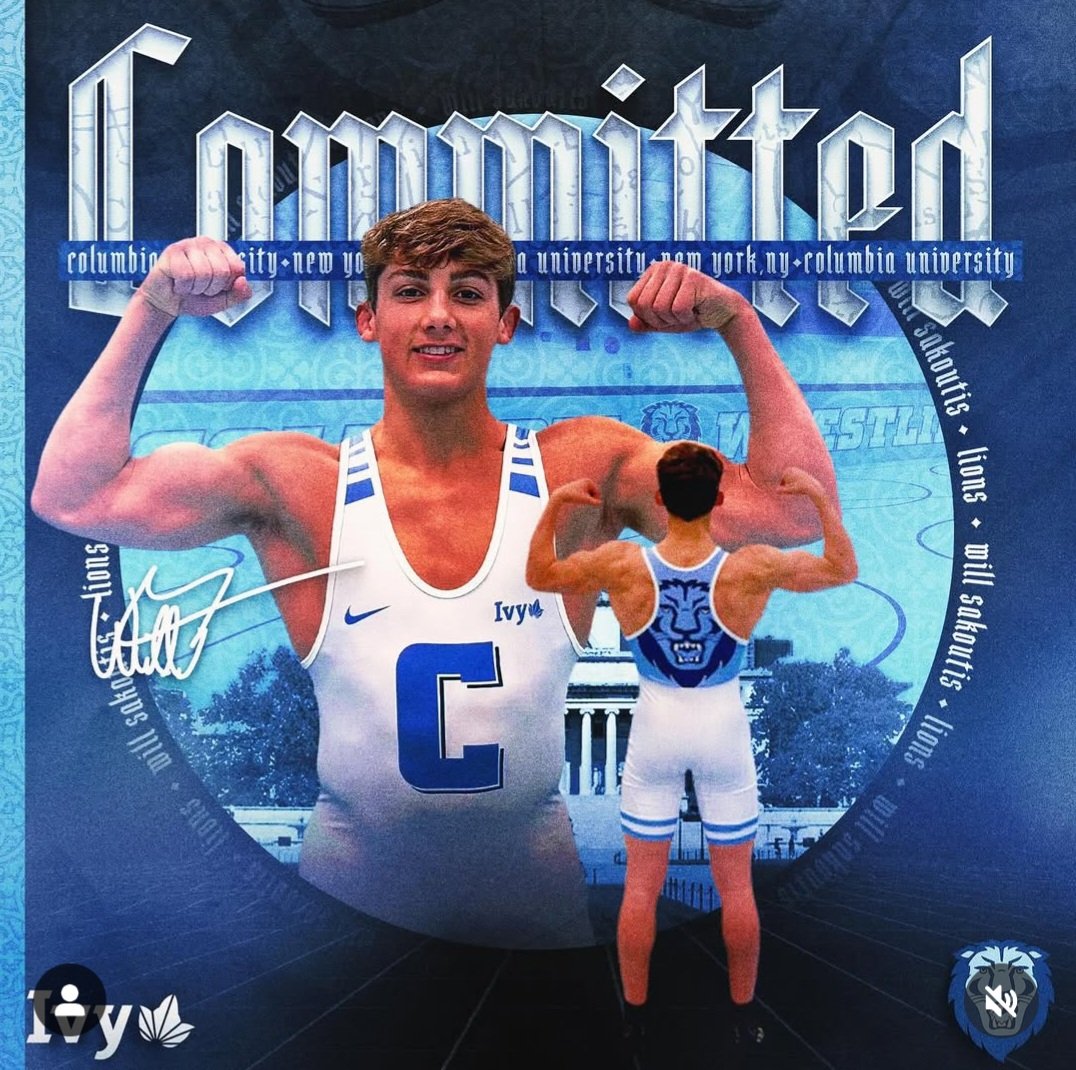

Will Sakoutis

Christian Brothers, New Jersey

Class of 2026

Committed to Columbia

Projected Weight: 149

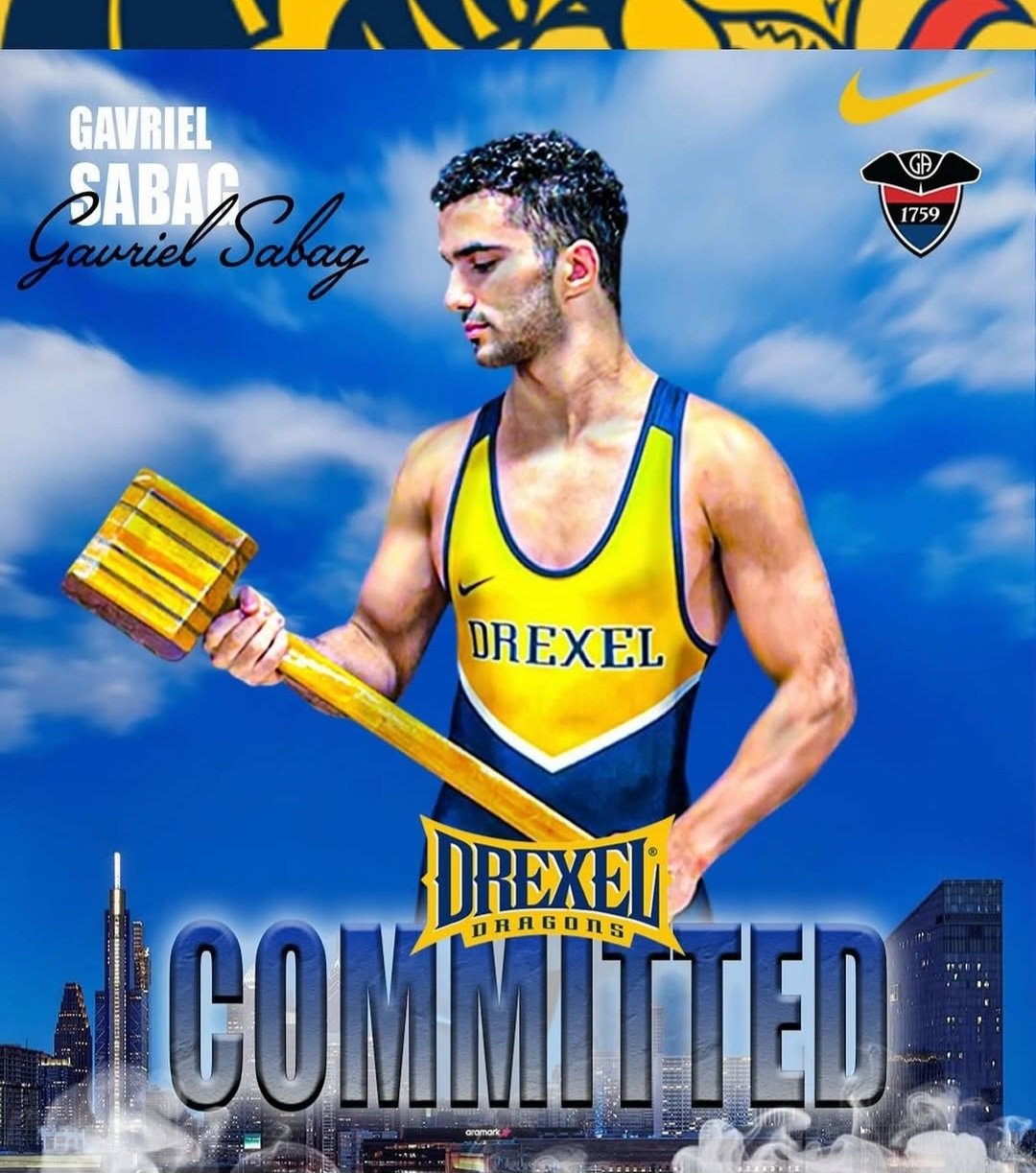

Gavriel Sabag

Germantown Academy, Pennsylvania

Class of 2026

Committed to Drexel

Projected Weight: 149

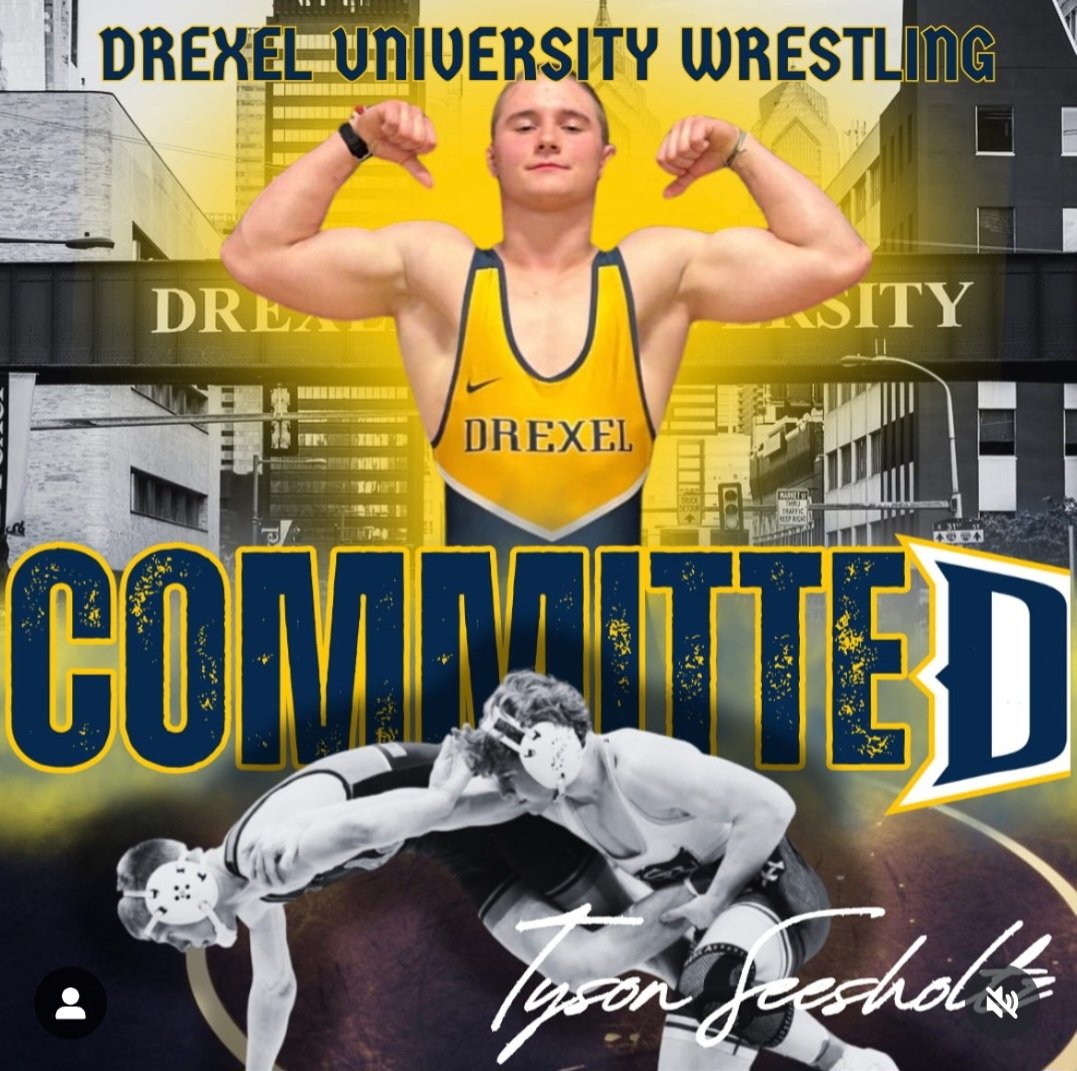

Tyson Seesholtz

South Range, Ohio

Class of 2026

Committed to Drexel

Projected Weight: 157

Eden Hernandez

Poway via North Central, California

Class of 2025

Committed to King (Women)

Projected Weight: 117

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now