IRS issues opinion that NIL Collectives not qualified as tax exempt

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

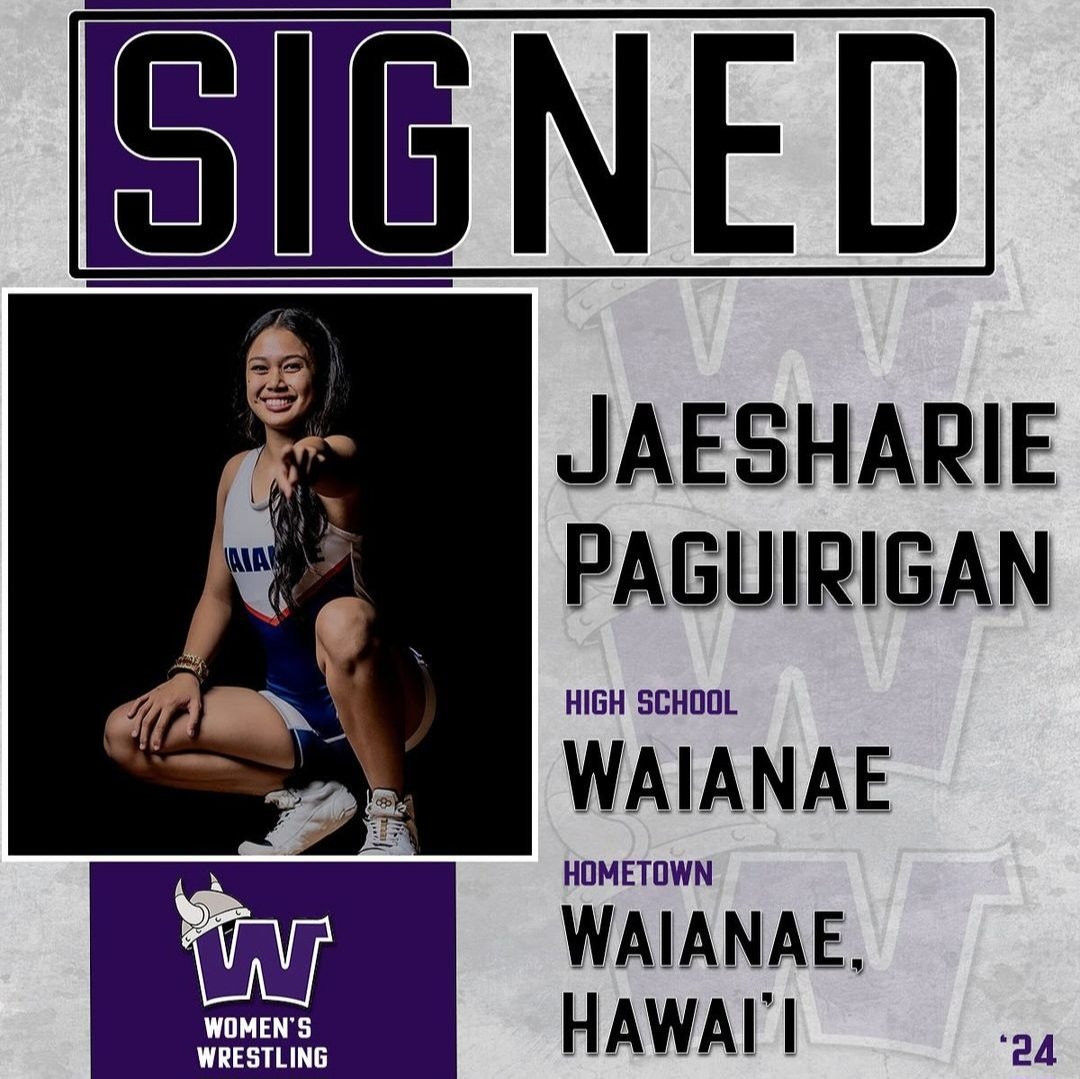

Jaesharie Paguirigan

Waianae, Hawaii

Class of 2024

Committed to Waldorf (Women)

Projected Weight: 130, 136

Alona Castro

Warden, Washington

Class of 2024

Committed to Waldorf (Women)

Projected Weight: 101

Alaina Kempen

Cadott, Wisconsin

Class of 2024

Committed to Waldorf (Women)

Projected Weight: 136

Lily Schultz

Gallatin, Montana

Class of 2024

Committed to Waldorf (Women)

Projected Weight: 143

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now