IRS issues opinion that NIL Collectives not qualified as tax exempt

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

College Commitments

Alex Taylor

Mount Vernon, Ohio

Class of 2026

Committed to Oklahoma

Projected Weight: 285

Mac Crosson

Indianola, Iowa

Class of 2027

Committed to Nebraska

Projected Weight: 165

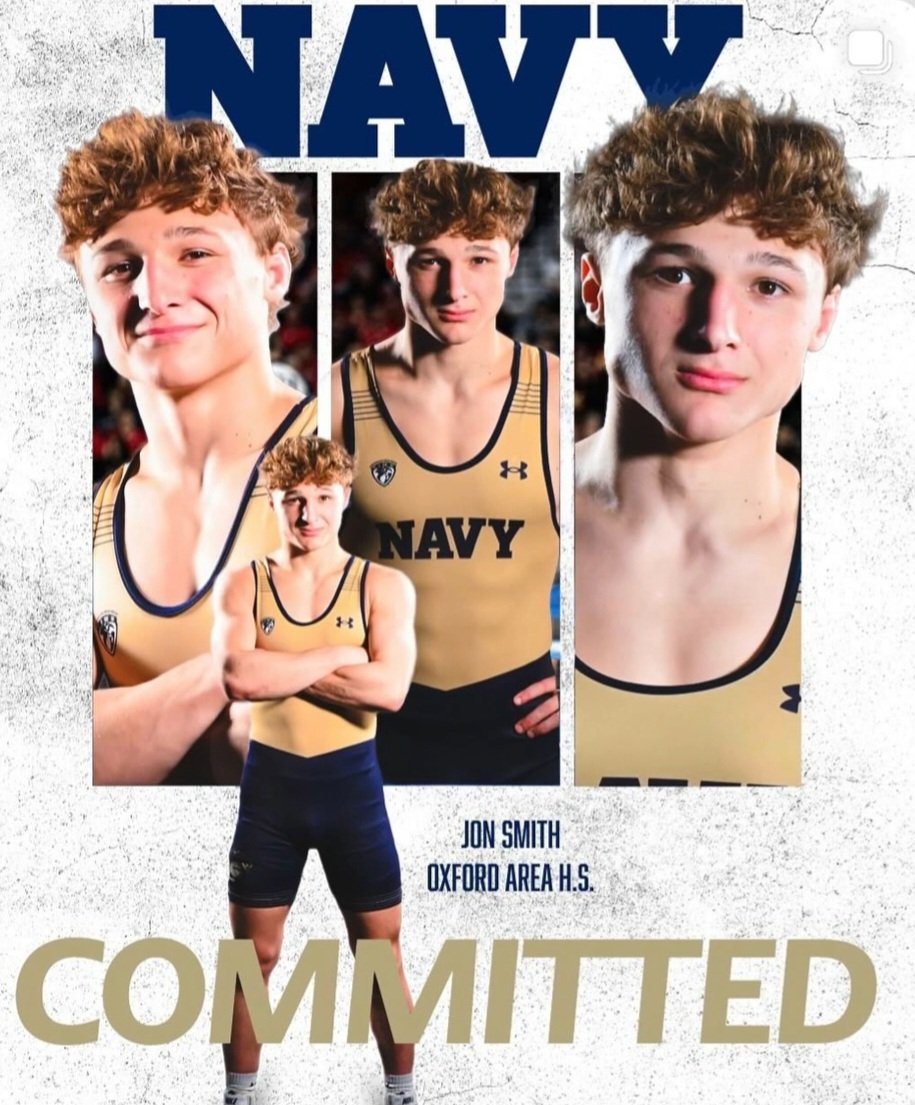

Jon Smith

Oxford Area, Pennsylvania

Class of 2027

Committed to Navy

Projected Weight: 174

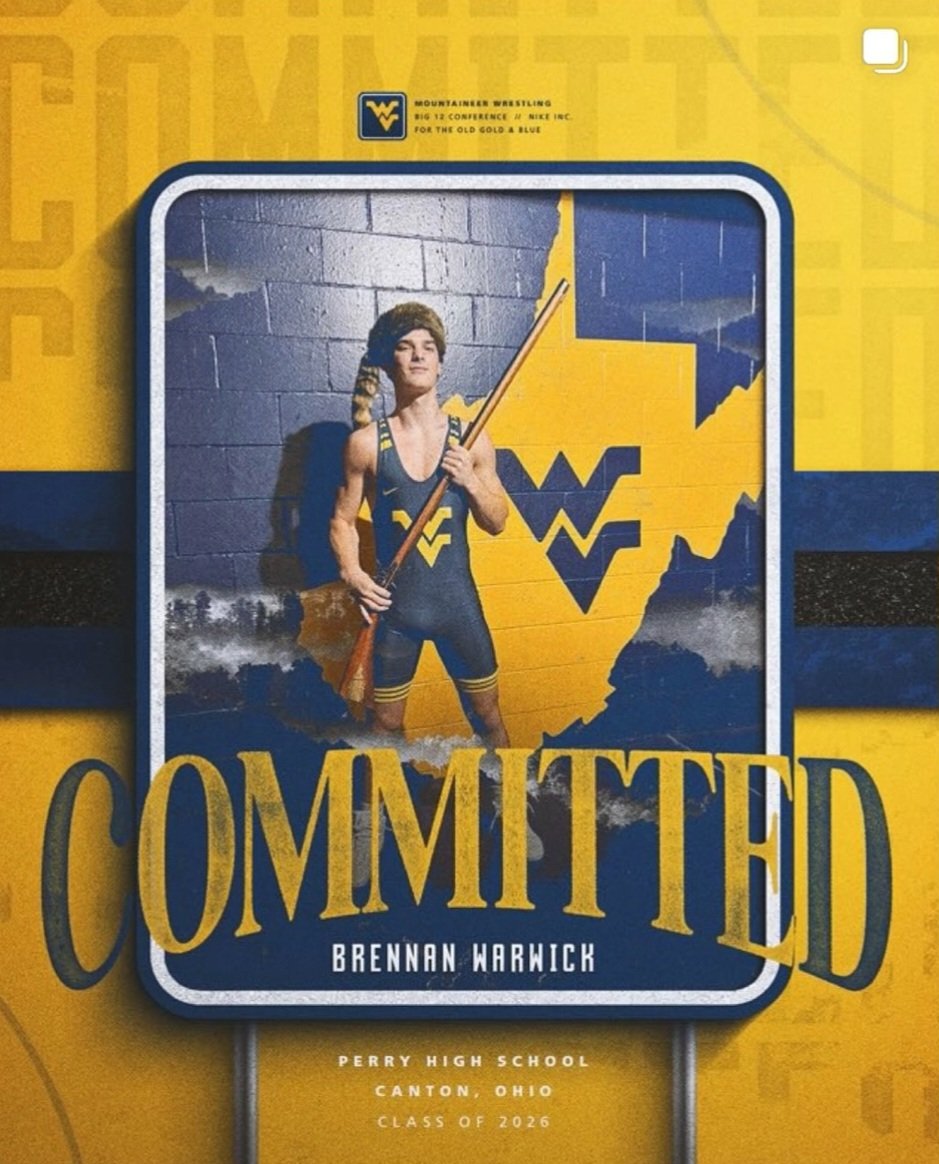

Brennan Warwick

Massillon Perry, Ohio

Class of 2026

Committed to West Virginia

Projected Weight: 174

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now