We Could EASILY Fix Inflation Without Raising Rates

-

Latest Rankings

-

Updated

-

Updated

-

Updated

-

Updated

-

-

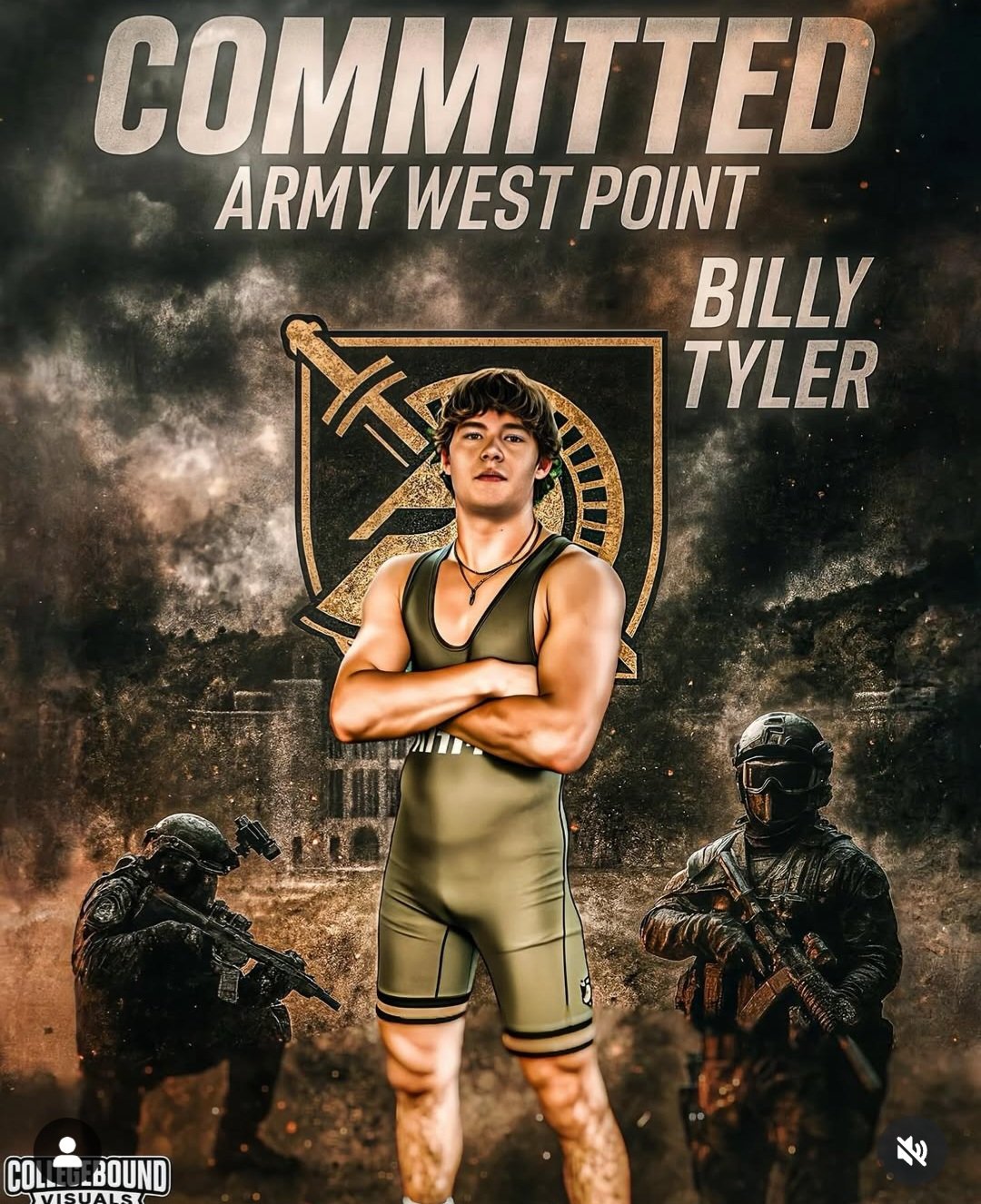

College Commitments

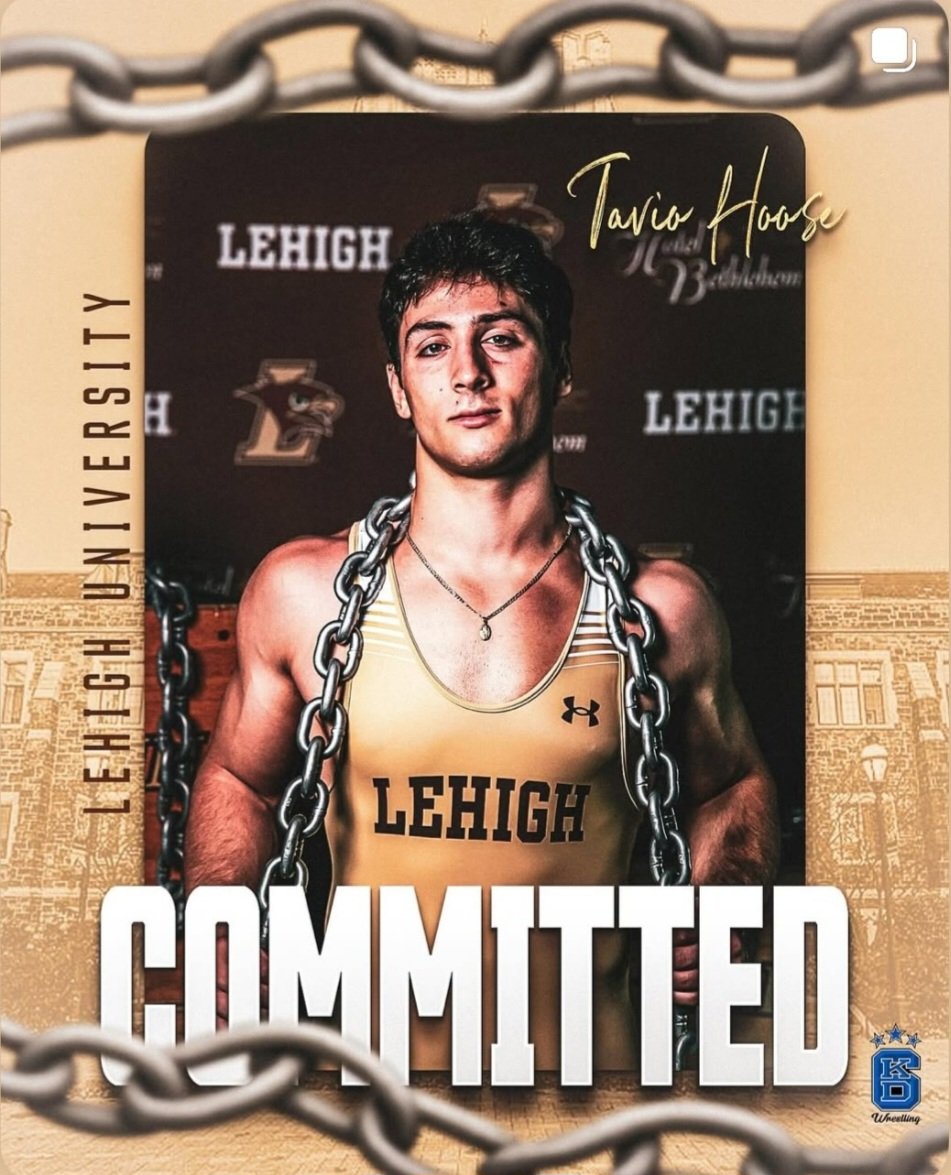

Tavio Hoose

St. Francis, New York

Class of 2026

Committed to Lehigh

Projected Weight: 197

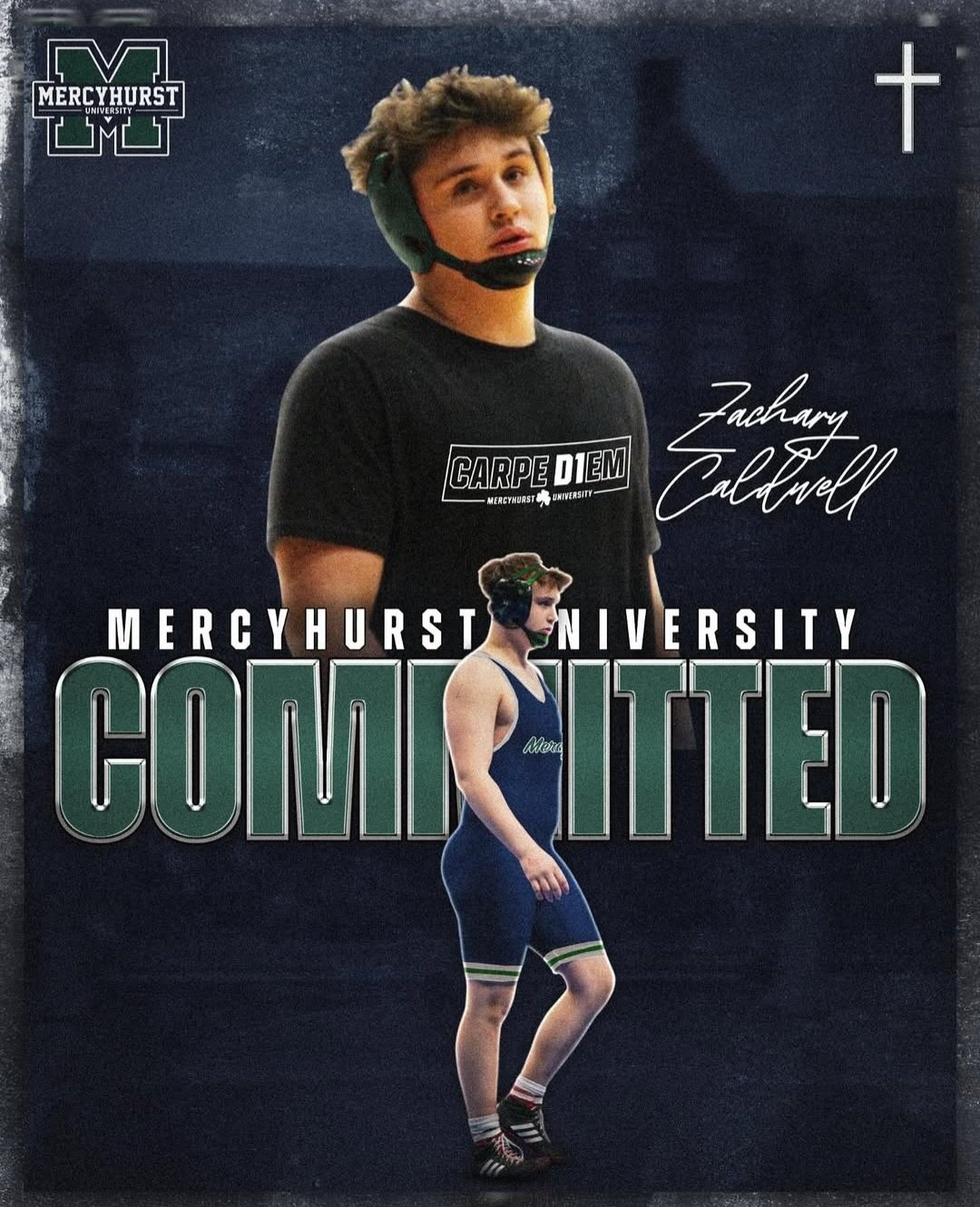

Zachary Caldwell

St. Francis, New York

Class of 2026

Committed to Mercyhurst

Projected Weight: 285

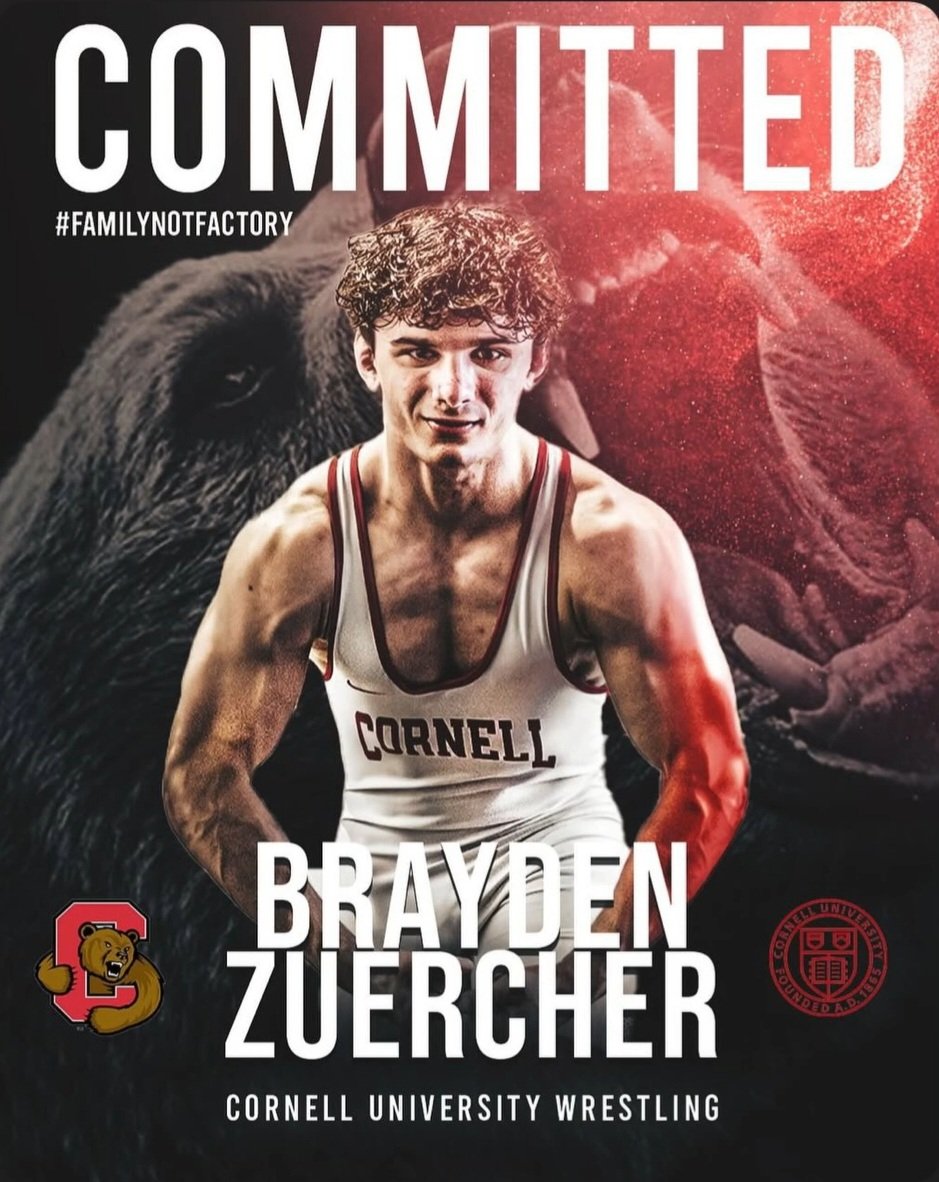

Brayden Zuercher

Nazareth, Pennsylvania

Class of 2026

Committed to Cornell

Projected Weight: 184, 197

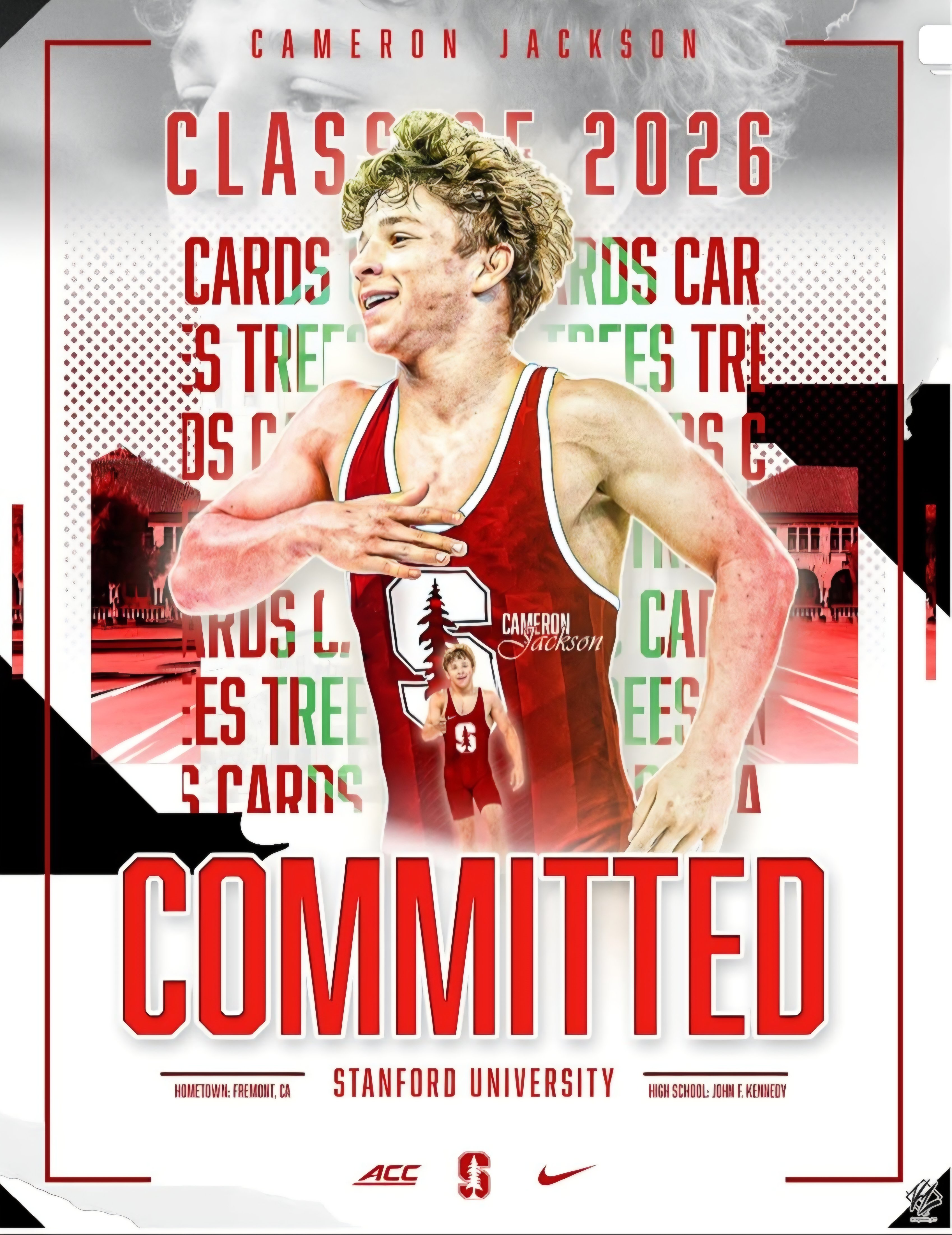

Cameron Jackson

Kennedy, California

Class of 2026

Committed to Stanford

Projected Weight: 125

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now